Introduction:

VTNR stock represents Vertex Energy, Inc., a leading environmental services company specializing in recycling and refining used motor oil. As the company continues to expand its operations and market presence, VTNR stock has garnered significant interest from investors. This blog post provides a comprehensive analysis of VTNR stock, examining its performance, potential, and future outlook.

Overview of Vertex Energy, Inc.:

Vertex Energy, Inc., trading under the ticker symbol VTNR, focuses on transforming waste materials into valuable products. The company’s commitment to sustainability and innovative recycling processes positions it as a key player in the environmental services sector.

VTNR Stock Market Debut:

VTNR stock made its market debut on the NASDAQ exchange, attracting attention for its unique business model and growth potential. Since its listing, VTNR stock has seen varying levels of investor interest and market activity.

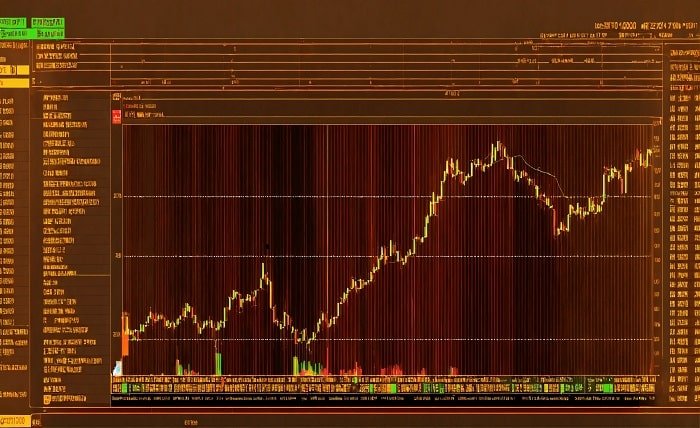

VTNR Stock Performance Analysis:

Analyzing VTNR stock’s performance involves looking at historical data, current trends, and future projections. This section delves into VTNR stock’s price movements, trading volume, and overall market sentiment.

Financial Health of Vertex Energy:

Investors in VTNR stock must understand Vertex Energy’s financial health. Key financial metrics such as revenue, net income, and cash flow provide insights into the company’s economic stability and growth potential.

Strategic Initiatives and Growth Drivers:

VTNR stock is influenced by Vertex Energy’s strategic initiatives and growth drivers. These include acquisitions, technological advancements, and expanding market reach. Understanding these factors can help investors gauge the potential for VTNR stock appreciation.

Competitive Landscape:

VTNR stock operates within a competitive market. This section compares Vertex Energy with other companies in the environmental services and recycling sectors, highlighting VTNR stock’s unique advantages and challenges.

Risks and Challenges for VTNR Stock:

Investing in VTNR stock comes with inherent risks. Potential investors should consider factors such as market volatility, regulatory changes, and operational challenges that could impact VTNR stock performance.

Expert Opinions and Analyst Ratings:

Expert opinions and analyst ratings provide valuable insights into VTNR stock. This section compiles various analysts’ perspectives on VTNR stock, including buy, hold, and sell recommendations.

Long-term Investment Potential:

VTNR stock’s long-term investment potential is tied to Vertex Energy’s strategic vision and market opportunities. This section explores the company’s long-term goals and how they may influence VTNR stock value over time.

Environmental Impact and Corporate Responsibility:

VTNR stock represents more than just financial returns; it also reflects Vertex Energy’s commitment to environmental sustainability and corporate responsibility. This section discusses how the company’s eco-friendly practices and initiatives align with global sustainability goals.

Conclusion:

VTNR stock offers a unique investment opportunity in the environmental services sector. With Vertex Energy’s focus on innovative recycling and sustainability, VTNR stock has the potential for significant growth. However, investors should carefully consider the associated risks and market dynamics before making investment decisions.

FAQs:

- What is VTNR stock? VTNR stock is the ticker symbol for Vertex Energy, Inc., a company specializing in recycling and refining used motor oil and other waste materials.

- How has VTNR stock performed historically? VTNR stock has experienced fluctuations in its market performance, influenced by various factors such as market trends, financial health, and strategic initiatives.

- What are the main growth drivers for VTNR stock? Growth drivers for VTNR stock include Vertex Energy’s strategic acquisitions, technological advancements, and expanding market reach in the environmental services sector.

- What risks are associated with investing in VTNR stock? Risks associated with VTNR stock include market volatility, regulatory changes, and operational challenges that could impact the company’s performance and stock value.

- Is VTNR stock a good long-term investment? VTNR stock has the potential for long-term growth, given Vertex Energy’s focus on sustainability and innovation. However, investors should carefully assess the risks and market conditions before making long-term investment decisions.