Leverage is a powerful tool in the world of trading, allowing traders to control larger positions with a relatively small amount of capital. One of the leading online trading platforms, OANDA, offers leverage options that can significantly enhance your trading potential. In this comprehensive guide, we’ll delve into the intricacies of OANDA leverage, helping you understand how it works, its advantages, and the associated risks.

What is Leverage?

Leverage in trading refers to the use of borrowed funds to increase the potential return on investment. When trading with OANDA leverage, traders can control larger positions than their initial capital would allow, amplifying both potential gains and losses.

How OANDA Leverage Works

OANDA leverage allows traders to open positions that are many times larger than their account balance. For example, with a leverage ratio of 50:1, you can control $50,000 worth of assets with just $1,000 in your account. This means your trading power is significantly increased, but so are the risks.

Benefits of Using OANDA Leverage

The primary benefit of using OANDA leverage is the potential for higher returns. By controlling larger positions, traders can achieve greater profits from smaller price movements. Additionally, leverage enables more efficient use of capital, allowing traders to diversify their investments across multiple assets.

Risks of OANDA Leverage

While OANDA leverage can magnify profits, it also increases the risk of significant losses. If the market moves against your position, your losses can exceed your initial investment. It’s crucial to use leverage cautiously and employ risk management strategies to protect your capital.

OANDA Leverage Ratios

OANDA offers different leverage ratios depending on the asset class and regulatory requirements. For major currency pairs, the leverage ratio can go up to 50:1, while for more volatile assets, it may be lower. Understanding these ratios is essential for effective trading.

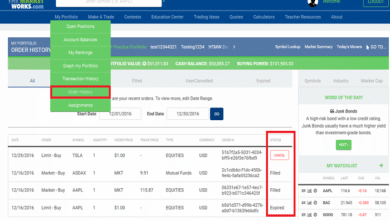

Margin Requirements and OANDA Leverage

Margin is the amount of money required to open a leveraged position. OANDA’s margin requirements vary based on the leverage ratio and the asset being traded. Traders must ensure they have sufficient margin in their accounts to maintain their positions and avoid margin calls.

How to Calculate OANDA Leverage

Calculating OANDA leverage is straightforward. Divide the total value of your position by the amount of capital in your account. For instance, if you have $1,000 in your account and control a $50,000 position, your leverage ratio is 50:1. This calculation helps you understand your exposure and manage your risk.

Strategies for Using OANDA Leverage

To effectively use OANDA leverage, traders should employ strategies such as stop-loss orders to limit potential losses, diversify their investments to spread risk, and regularly monitor their positions. These strategies help mitigate the risks associated with leveraged trading.

Regulatory Considerations for OANDA Leverage

OANDA operates under the regulations of various financial authorities, which impose limits on leverage to protect traders. It’s important to be aware of these regulations and ensure your trading activities comply with them. Different regions may have different leverage limits, affecting how you trade.

Tips for Beginners on OANDA Leverage

For beginners, it’s crucial to start with a low leverage ratio to understand how it impacts your trades. Practice with a demo account to gain experience without risking real money. Educate yourself on risk management techniques and gradually increase your leverage as you become more comfortable and knowledgeable.

Conclusion

OANDA leverage is a powerful tool that can enhance your trading potential by allowing you to control larger positions with a smaller amount of capital. However, it comes with significant risks that require careful management and a solid understanding of how leverage works. By using OANDA leverage wisely and employing robust risk management strategies, traders can maximize their potential for success while minimizing the chances of substantial losses.

Discover powerful stock market insights with chartink . Track stock trends, analyze charts, and create custom stock screeners to make informed trading decisions with this comprehensive charting tool.

FAQs

1.What is OANDA leverage?

OANDA leverage allows traders to control larger positions than their account balance would typically allow by using borrowed funds.

2.How does OANDA leverage work?

OANDA leverage amplifies your trading power by allowing you to open positions that are multiple times larger than your initial capital, based on a specific leverage ratio.

3.What are the risks of using OANDA leverage?

The main risk of OANDA leverage is the potential for significant losses, which can exceed your initial investment if the market moves against your position.

4.What are the margin requirements for OANDA leverage?

Margin requirements vary based on the leverage ratio and the asset being traded. It’s the minimum amount of capital needed to open and maintain a leveraged position.

5.How can beginners use OANDA leverage safely?

Beginners should start with a low leverage ratio, practice with a demo account, and employ risk management strategies such as stop-loss orders to limit potential losses.

Courselinkfree.us offers free access to a wide variety of online courses. Explore educational resources across multiple subjects and enhance your skills with easy-to-follow lessons and materials.