My Watchlist Stocks Today: A Comprehensive Guide for Smart Investors

Introduction

When it comes to investing, the importance of a well-curated watchlist can’t be overstated. “My watchlist stocks today” serves as an essential tool for investors, helping to track, analyze, and stay updated on potential investment opportunities. The ever-changing nature of the stock market means that having an updated watchlist ensures that investors are always prepared to make informed decisions based on real-time data. By understanding what stocks are worth monitoring today, investors can create a strategy that aligns with their financial goals.

“My watchlist stocks today” isn’t just a list; it’s a curated selection of stocks chosen based on market trends, personal investment strategies, and economic indicators. Building a robust watchlist requires research, understanding market signals, and being attentive to stocks that demonstrate promising performance or align with one’s financial strategy.

How to Choose Stocks for My Watchlist Today

Selecting stocks for my watchlist involves analyzing multiple factors that influence a stock’s performance. Identifying the right stocks isn’t merely about picking popular names or trending companies; it requires a balanced approach considering market trends, sector performance, company fundamentals, and investment goals.

Investors often start by focusing on sectors or industries they believe will perform well based on market conditions. For example, during times of technological advancement, technology stocks might be more favorable. Similarly, understanding company fundamentals, such as earnings reports, market cap, and revenue growth, can be instrumental in refining “my watchlist stocks today” to align with informed decision-making. Keeping these aspects in mind helps investors build a diverse and resilient watchlist.

Importance of Diversifying My Watchlist Stocks Today

Diversification is a core principle of investing that applies strongly to “my watchlist stocks today.” By including stocks from various industries, regions, and sectors, investors reduce the risk of losing money due to market fluctuations affecting a single sector. For instance, if technology stocks take a downturn, having stocks from other industries, such as healthcare or utilities, in “my watchlist stocks today” helps stabilize potential losses.

A diversified watchlist not only minimizes risks but also increases the chances of identifying stocks with growth potential across different markets. Diversification also encourages a proactive approach to investment, where tracking and analyzing trends in various sectors gives investors a broader perspective of the market. Consequently, a diversified watchlist allows for smoother portfolio management and more stable investment outcomes.

Real-Time Tracking of My Watchlist Stocks Today

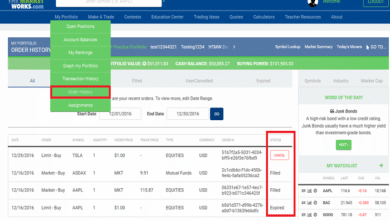

One of the advantages of a watchlist is the ability to track stocks in real time. Monitoring “my watchlist stocks today” involves staying updated on stock price fluctuations, market news, and any breaking news that could impact stock prices. Real-time tracking tools are invaluable, as they provide live updates, alerts, and market analytics that allow investors to act quickly when opportunities arise.

With advancements in technology, investors can now use trading platforms, mobile apps, and financial news portals to keep an eye on “my watchlist stocks today.” These tools allow for customization, where alerts can be set for specific price points or news events. Real-time tracking ensures that investors are not caught off guard by sudden market shifts and can make timely decisions based on updated information.

Analyzing Trends and Patterns in My Watchlist Stocks Today

Understanding market trends and identifying patterns is crucial for creating a strong watchlist. “My watchlist stocks today” should reflect not only high-performing stocks but also stocks showing favorable trends, such as consistent growth or resilience during market downturns. Investors often analyze historical data, moving averages, and price patterns to predict future performance.

Trends can be influenced by broader economic conditions, such as interest rate changes, inflation, and consumer spending. For instance, in times of economic stability, consumer stocks might perform well, while in uncertain economic climates, defensive stocks might be more reliable. Therefore, analyzing trends and adjusting “my watchlist stocks today” according to observed patterns is a proactive approach to maximizing returns.

My Watchlist Stocks Today: Short-Term vs. Long-Term Picks

When building “my watchlist stocks today,” it’s essential to consider both short-term and long-term investment perspectives. Short-term stocks are typically volatile, with potential for quick gains, while long-term stocks are more stable, promising steady growth over time. Balancing short-term and long-term stocks on your watchlist can align your strategy with your financial goals.

Short-term stocks on “my watchlist stocks today” may include trending companies, upcoming IPOs, or stocks with high trading volume. Conversely, long-term stocks are chosen based on factors like stable earnings, market dominance, and consistent performance over several years. Determining a mix of short-term and long-term stocks provides a comprehensive approach to building a watchlist that adapts to different market conditions.

How Economic Indicators Affect My Watchlist Stocks Today

Economic indicators such as GDP growth, inflation rates, and employment data can have a significant impact on the stock market and influence “my watchlist stocks today.” By monitoring these indicators, investors can adjust their watchlist to include stocks that are more likely to benefit from current economic trends.

For instance, in a high-inflation environment, consumer staples and utility stocks tend to perform better. During economic growth, cyclical stocks like travel and leisure might experience gains. Being aware of these indicators and their potential impact on various sectors can help investors align “my watchlist stocks today” with broader economic trends, increasing the likelihood of identifying profitable stocks.

The Role of Earnings Reports in Shaping My Watchlist Stocks Today

Earnings reports provide crucial insights into a company’s financial health and often impact stock prices significantly. When curating “my watchlist stocks today,” investors should consider the earnings season, as these reports can lead to price movements that present buying or selling opportunities.

Earnings reports cover revenue, net income, and forward guidance, providing investors with a snapshot of a company’s performance and future prospects. Monitoring these reports and understanding how they affect the stocks on “my watchlist stocks today” enables investors to make informed decisions. Companies that consistently meet or exceed earnings expectations are often reliable additions to a watchlist, whereas companies that miss earnings projections may require re-evaluation.

Impact of Global Events on My Watchlist Stocks Today

Global events, such as political changes, trade agreements, and international conflicts, can have a substantial impact on the stock market. When these events unfold, they often lead to immediate shifts in stock prices and affect investor sentiment. For “my watchlist stocks today,” it is essential to consider stocks that may react to these global developments.

Stocks in industries such as energy, defense, and technology are frequently affected by global events. For instance, changes in oil prices can influence energy stocks, while trade agreements can impact manufacturing and technology sectors. By considering global events and adjusting “my watchlist stocks today,” investors can proactively manage their watchlist to stay ahead of potential risks or capitalize on emerging opportunities.

Evaluating the Performance of My Watchlist Stocks Today

Regular evaluation is crucial to ensure that “my watchlist stocks today” remains aligned with investment goals and market conditions. Performance evaluation involves reviewing stock prices, news, and any changes in a company’s fundamentals. It also requires re-assessment of the investment strategy to ensure that the watchlist continues to meet an investor’s financial objectives.

Performance evaluation can be done weekly, monthly, or quarterly, depending on the investor’s preferences. This assessment provides insight into which stocks should remain on “my watchlist stocks today” and which should be replaced with better-performing alternatives. By regularly evaluating and updating the watchlist, investors can maintain a dynamic selection of stocks that adapts to market changes and personal investment goals.

Conclusion

“My watchlist stocks today” is a powerful tool for anyone serious about making informed investment decisions. It helps investors track market trends, analyze company performance, and manage risks effectively. A well-curated watchlist allows for a structured approach to investing, where stocks are chosen based on research, economic indicators, and personal financial goals.

By regularly updating and reviewing “my watchlist stocks today,” investors can stay proactive in a fluctuating market. Whether the goal is short-term profit or long-term growth, a thoughtfully managed watchlist is essential. In conclusion, an effective watchlist serves as both a guide and a strategy for navigating the complexities of the stock market, making it an indispensable asset for all investors.

FAQs

Q1: How often should I update my watchlist stocks today?

A: Updating “my watchlist stocks today” depends on your investment strategy; it can be done daily, weekly, or monthly, depending on market activity and investment goals.

Q2: Is real-time tracking essential for my watchlist stocks today?

A: Real-time tracking is beneficial as it provides live updates, allowing you to make quick decisions on “my watchlist stocks today” based on current market trends.

Q3: Can global events impact my watchlist stocks today?

A: Yes, global events often influence stock prices, so being aware of international news helps in managing “my watchlist stocks today.”

Q4: What types of stocks should I include in my watchlist?

A: Including a mix of short-term and long-term stocks, as well as diversified sectors, can make “my watchlist stocks today” balanced and resilient to market shifts.

Q5: How can I use earnings reports to adjust my watchlist stocks today?

A: Earnings reports highlight a company’s financial performance, and reviewing them helps determine which stocks to add or remove from “my watchlist stocks today.