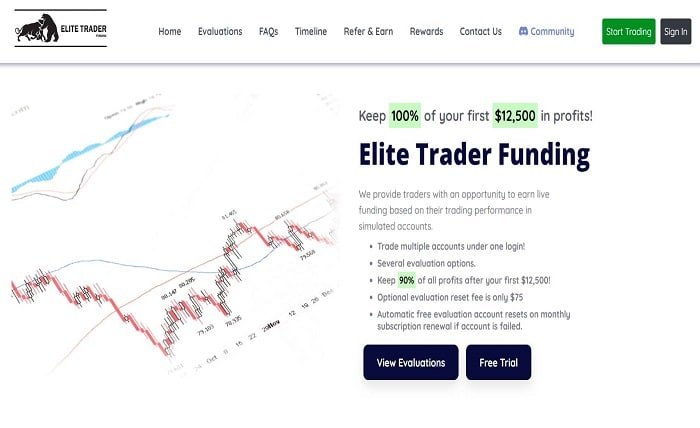

Elite trader funding represents a significant opportunity for traders looking to expand their reach and potential in the financial markets without committing large amounts of personal capital. This blog post explores everything from the basics of obtaining trader funding to advanced strategies for maintaining and growing funded accounts.

Elite Trader Funding: What It Is and How It Works

Elite trader funding provides financial resources to traders who demonstrate exceptional skill and strategy but may lack the capital to fully leverage their trading abilities. This section will delve into the concept of trader funding, discussing its structure, the typical entities that provide such funding, and the general operational model.

The Benefits of Securing Trader Funding

Trader funding can dramatically increase a trader’s ability to participate in markets, take larger positions, and potentially earn significant returns. We will explore the advantages of having access to increased capital, including the ability to diversify trading strategies and manage risks more effectively.

Eligibility Criteria for Trader Funding

Not every trader will qualify for elite trader funding. This part of the post will outline the common qualifications required by funding providers, such as trading history, strategy robustness, and risk management skills.

The Application Process: Steps to Acquire Funding

Securing funding involves a detailed application process. This section breaks down the steps from application to approval, including tips on how to prepare a compelling case for funding and what documentation is typically necessary.

Different Types of Trader Funding Programs

There are various funding programs available, each with its unique features and focus areas. We will review some of the most popular types of trader funding, such as prop trading firms, private equity partnerships, and online funding challenges.

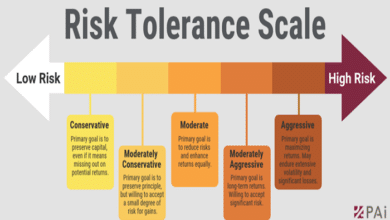

Risks and Challenges in Trader Funding

While trader funding offers numerous benefits, it also comes with its own set of risks and challenges. This segment discusses potential downsides, such as the pressure to perform, the implications of not meeting certain benchmarks, and how these factors can affect a trader’s decision-making.

Best Practices for Managing a Funded Account

Managing a funded account successfully requires different strategies compared to trading with one’s own capital. This section offers best practices such as risk management, compliance with funding terms, and techniques for effective capital utilization.

The Impact of Technology on Elite Trader Funding

Technology plays a crucial role in modern trading and by extension, in trader funding. This part examines how advancements in trading platforms, analytical tools, and data accessibility influence trader performance and funding opportunities.

Real-Life Success Stories: Case Studies of Funded Traders

To illustrate the potential of elite trader funding, we will share several success stories of traders who have effectively used funding to achieve their trading goals, highlighting key lessons and strategies that helped them succeed.

The Future of Trader Funding

What does the future hold for elite trader funding? This concluding section looks ahead at trends, potential changes in the funding landscape, and how traders can prepare for future opportunities.

Conclusion:

Elite trader funding offers a path to significant opportunities in the trading world. By understanding the intricacies of obtaining and managing trader funding, traders can optimize their trading strategies and potentially achieve great success. Remember, the key to maximizing the benefits of trader funding lies in diligent preparation, robust risk management, and continual learning and adaptation.

FAQs

1.What is the minimum experience required for elite trader funding?

Most funding providers look for traders with at least a few years of successful trading experience, though exact requirements can vary.

2.How much capital can I access through trader funding?

Funding amounts can range widely depending on the provider and the trader’s skill level, often from tens of thousands to several millions of dollars.

3.Are there any costs associated with obtaining trader funding?

Some programs may require a participation fee or a share in the profits generated from trading activities, but structures vary significantly between programs.

4.What happens if I lose the funded money?

Typically, traders are not liable for losses beyond the funded amount, but losing funding can mean disqualification from future programs.

5.Can I participate in multiple funding programs simultaneously?

This depends on the terms set by the funding providers; some may allow it while others require exclusivity.