Introduction

In the ever-evolving world of forex trading, the concept of prop trading firms has gained significant traction. Among the many firms out there, OANDA prop firm stands out as a prominent player, offering unique opportunities and advantages to traders. In this blog post, we will delve into the intricacies of OANDA prop firm, exploring its benefits, strategies, and tips for success.

What is OANDA Prop Firm?

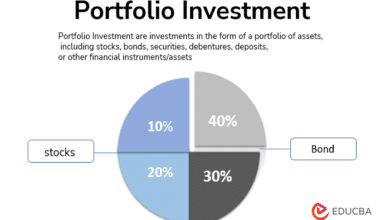

OANDA prop firm is a proprietary trading firm that provides traders with the capital and resources to trade the forex market. Unlike traditional trading where traders use their own funds, prop trading firms like OANDA offer capital to traders, allowing them to trade larger positions and potentially earn higher profits.

Benefits of Trading with OANDA Prop Firm

One of the main benefits of trading with OANDA prop firm is access to significant trading capital. This allows traders to leverage larger positions and increase their potential returns. Additionally, OANDA prop firm provides advanced trading platforms, educational resources, and professional support to help traders succeed.

How to Get Started with OANDA Prop Firm

Getting started with OANDA prop firm involves a few key steps. First, traders need to apply to the firm and demonstrate their trading skills. This often includes passing a trading evaluation or providing a track record of profitable trading. Once accepted, traders receive capital and can begin trading.

Trading Strategies for Success

Successful trading with OANDA prop firm requires a solid strategy. Traders often use a combination of technical analysis, fundamental analysis, and risk management techniques. It’s crucial to develop a trading plan and stick to it, adjusting strategies as market conditions change.

Risk Management in OANDA Prop Trading

Risk management is a critical aspect of trading with OANDA prop firm. Traders must set stop-loss orders, manage their leverage, and diversify their trades to mitigate risk. OANDA prop firm provides tools and resources to help traders manage their risk effectively.

Leveraging OANDA’s Trading Platforms

OANDA offers state-of-the-art trading platforms that are essential for prop traders. These platforms provide advanced charting tools, real-time market data, and fast execution speeds. Utilizing these platforms effectively can enhance trading performance and improve decision-making.

The Importance of Continuous Learning

Continuous learning is vital for success in OANDA prop firm trading. Markets are dynamic, and traders need to stay updated with the latest trends, news, and strategies. OANDA prop firm offers educational resources, webinars, and mentorship programs to support traders’ growth.

Common Challenges and How to Overcome Them

Trading with OANDA prop firm can present challenges such as emotional trading, market volatility, and maintaining discipline. Overcoming these challenges requires a strong mindset, discipline, and the ability to stick to a trading plan. OANDA’s support and resources can help traders navigate these challenges.

Success Stories: Learning from Top Traders

Many successful traders have started their careers with prop firms like OANDA. Studying their journeys, strategies, and experiences can provide valuable insights. OANDA prop firm often shares success stories and case studies to inspire and educate aspiring traders.

Conclusion

OANDA prop firm presents a unique opportunity for traders to access significant capital, advanced trading platforms, and professional support. By leveraging these resources, traders can enhance their trading performance and achieve their financial goals. Whether you’re an experienced trader or just starting, OANDA prop firm offers the tools and environment needed to succeed in the competitive world of forex trading.

FAQs

Q1: What is the minimum capital provided by OANDA prop firm?

The minimum capital provided varies, but OANDA prop firm typically offers sufficient funds to start trading significant positions.

Q2: Do I need prior trading experience to join OANDA prop firm?

While prior experience is beneficial, OANDA prop firm also considers traders with strong potential and a willingness to learn.

Q3: How does profit sharing work at OANDA prop firm?

Profit sharing at OANDA prop firm typically involves a split between the trader and the firm, with specific percentages agreed upon in advance.

Q4: Can I trade other instruments besides forex with OANDA prop firm?

Yes, OANDA prop firm allows trading in various instruments, including commodities, indices, and cryptocurrencies, depending on the trader’s expertise.

Q5: What support does OANDA prop firm provide to traders?

OANDA prop firm offers extensive support, including access to advanced trading platforms, educational resources, mentorship, and risk management tools.