Coinbase Stock: A Comprehensive Guide to Investing in COIN

Introduction:

Coinbase stock, trading under the ticker symbol COIN, has garnered significant attention since its public debut. As one of the leading cryptocurrency exchanges in the world, Coinbase represents a unique opportunity for investors to gain exposure to the rapidly growing digital currency market. This blog post explores the intricacies of Coinbase stock, its market performance, and the factors that investors should consider.

The Rise of Coinbase:

Coinbase was founded in 2012 and has since grown to become a major player in the cryptocurrency exchange industry. The launch of Coinbase stock marked a significant milestone for the company, reflecting its influence and potential in the financial markets.

Coinbase Stock IPO:

The Initial Public Offering (IPO) of Coinbase stock occurred in April 2021. This direct listing on the NASDAQ allowed investors to buy and sell shares of COIN, bringing significant attention and capital to the company.

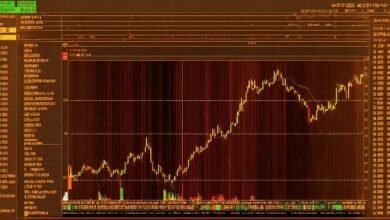

Market Performance of COIN:

Since its IPO, Coinbase stock has experienced notable volatility, typical of the cryptocurrency market. This section examines the stock’s performance, highlighting key moments and trends that have influenced its value.

Financial Health of Coinbase:

Investors in Coinbase stock need to understand the company’s financial health. Analyzing quarterly earnings, revenue growth, and profitability provides insights into how well Coinbase is managing its operations and navigating market challenges.

Competitive Landscape:

Coinbase stock operates in a highly competitive environment. Understanding its position relative to other cryptocurrency exchanges, such as Binance and Kraken, is crucial for assessing its long-term prospects and market share.

Factors Influencing COIN’s Value:

Several factors impact the value of Coinbase stock, including cryptocurrency market trends, regulatory developments, and technological advancements. This section explores these factors and their potential effects on COIN.

Investment Potential:

For investors considering Coinbase stock, it’s important to weigh its potential for growth against the inherent risks. This section discusses the bullish and bearish perspectives on COIN, helping investors make informed decisions.

Risks and Challenges:

Investing in Coinbase stock comes with risks, such as regulatory scrutiny and market volatility. Identifying and understanding these risks is crucial for any investor looking to add COIN to their portfolio.

Analyst Opinions and Forecasts:

Expert opinions and forecasts provide valuable insights into the future trajectory of Coinbase stock. This section compiles various analysts’ views on COIN, offering a balanced perspective on its potential performance.

Long-term Outlook:

The long-term outlook for Coinbase stock is tied to the broader adoption of cryptocurrencies and blockchain technology. This section explores how these trends might shape the future of COIN and its role in the financial ecosystem.

Conclusion:

Coinbase stock represents a unique entry point into the cryptocurrency market for traditional investors. While COIN offers significant potential for growth, it also comes with substantial risks. By staying informed about market trends, financial health, and industry developments, investors can better navigate the complexities of investing in Coinbase stock.

Stay updated with the latest nasik fatafat results. Discover how to check live results, winning strategies, and expert tips. Don’t miss out on your chance to win big in Nasik Fatafat!

FAQs:

- What is Coinbase stock? Coinbase stock, traded under the ticker symbol COIN, represents shares of Coinbase Global Inc., a leading cryptocurrency exchange.

- When did Coinbase go public? Coinbase went public in April 2021 through a direct listing on the NASDAQ, allowing investors to trade COIN shares.

- How has Coinbase stock performed since its IPO? Since its IPO, Coinbase stock has experienced significant volatility, reflecting the broader trends and uncertainties in the cryptocurrency market.

- What factors influence the value of Coinbase stock? The value of Coinbase stock is influenced by factors such as cryptocurrency market trends, regulatory changes, and the company’s financial performance.

- Is Coinbase stock a good long-term investment? Coinbase stock has potential for long-term growth, but it also carries risks. Investors should consider market trends, the company’s competitive position, and regulatory factors before investing in COIN.

Explore trendzguruji.me , your go-to platform for the latest trends in technology, entertainment, and lifestyle. Stay updated with expert insights, tips, and trending news all in one place.