Asset Classes: Building a Diversified Portfolio

Introduction

Asset classes is fundamental to building a diversified investment portfolio. Asset classes are categories of investments that exhibit similar characteristics and are subject to the same laws and regulations. Knowing the different asset classes helps investors balance risk and reward, creating a more resilient financial strategy.

What Are Asset Classes?

Asset classes are groups of financial instruments that behave similarly in the market. The main asset classes include equities, fixed income, real estate, commodities, and cash equivalents. Each asset class has its own risk and return profile, making it essential to understand their characteristics to create a balanced investment portfolio.

Equities: The Growth Engine

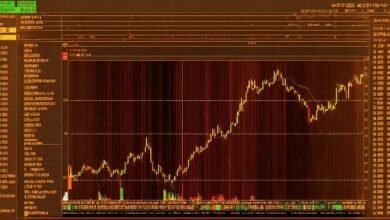

Equities, also known as stocks, represent ownership in a company. As an asset class, equities are known for their potential to generate high returns, but they also come with higher risk compared to other asset classes. Investors buy equities with the expectation that the value of the company will increase over time, leading to capital gains and, in some cases, dividend income.

Fixed Income: Stability and Income

Fixed income securities, such as bonds, are debt instruments that pay regular interest to investors. This asset class is known for providing stable income and preserving capital. Governments and corporations issue bonds to raise funds, and in return, they promise to pay interest and return the principal at maturity. Fixed income investments are generally considered lower risk than equities but offer lower returns.

Real Estate: Tangible Assets

Real estate is a popular asset class that involves investing in physical properties like residential homes, commercial buildings, and land. Real estate investments can provide rental income, capital appreciation, and tax advantages. This asset class is known for its ability to hedge against inflation and provide diversification to an investment portfolio.

Commodities: Physical Goods

Commodities are physical goods such as gold, silver, oil, and agricultural products. Investing in commodities can provide a hedge against inflation and diversify an investment portfolio. Commodities tend to have a low correlation with other asset classes, making them a valuable addition for risk management.

Cash Equivalents: Liquidity and Safety

Cash equivalents include short-term, highly liquid investments like Treasury bills, money market funds, and certificates of deposit. This asset class is known for its safety and liquidity, providing investors with a place to park funds while earning a small return. Cash equivalents are essential for maintaining liquidity in a diversified portfolio.

Alternative Investments: Diversification Beyond Traditional Assets

Alternative investments encompass a wide range of assets that fall outside traditional asset classes, such as private equity, hedge funds, and collectibles. These investments can provide additional diversification and potential high returns but often come with higher risk and less liquidity. Understanding the role of alternative investments can help sophisticated investors enhance their portfolios.

The Importance of Diversification

Diversification is a key principle in investing, spreading investments across different asset classes to reduce risk. By holding a mix of assets like equities, fixed income, real estate, and commodities, investors can protect their portfolios from market volatility and increase the potential for long-term growth. Diversification ensures that poor performance in one asset class does not disproportionately impact the overall portfolio.

Asset Allocation Strategies

Asset allocation involves dividing an investment portfolio among different asset classes based on an investor’s goals, risk tolerance, and time horizon. Common asset allocation strategies include conservative, balanced, and aggressive approaches. A well-thought-out asset allocation strategy can help investors achieve their financial objectives while managing risk.

Rebalancing Your Portfolio

Rebalancing is the process of realigning the weightings of a portfolio’s asset classes to maintain the desired risk and return profile. Over time, the performance of different asset classes can cause the portfolio to drift from its target allocation. Regular rebalancing ensures that the portfolio remains aligned with the investor’s goals and risk tolerance.

The Role of Asset Classes in Risk Management

Different asset classes react differently to market conditions, making them crucial for risk management. By combining asset classes with varying risk and return profiles, investors can create a more stable and resilient portfolio. Understanding how each asset class contributes to overall risk and return is essential for effective portfolio management.

The Future of Asset Classes

The investment landscape is continuously evolving, with new asset classes and investment opportunities emerging. Technological advancements, changing economic conditions, and evolving investor preferences shape the future of asset classes. Staying informed about these trends can help investors adapt their strategies and take advantage of new opportunities.

Conclusion

Understanding asset classes is fundamental to building a diversified investment portfolio that balances risk and reward. By exploring equities, fixed income, real estate, commodities, and cash equivalents, investors can create a robust financial strategy. Diversification, asset allocation, and regular rebalancing are essential practices for long-term investment success.

FAQs

1. What are the main asset classes?

The main asset classes are equities, fixed income, real estate, commodities, and cash equivalents. Each asset class has distinct characteristics and risk-return profiles.

2. Why is diversification important in investing?

Diversification spreads investments across different asset classes, reducing risk and increasing the potential for long-term growth. It ensures that poor performance in one asset class does not disproportionately impact the overall portfolio.

3. What is asset allocation?

Asset allocation is the process of dividing an investment portfolio among different asset classes based on the investor’s goals, risk tolerance, and time horizon. It helps manage risk and achieve financial objectives.

4. How often should I rebalance my portfolio?

Rebalancing should be done regularly, typically annually or semi-annually, to maintain the desired asset allocation. It ensures the portfolio remains aligned with the investor’s goals and risk tolerance.

5. What are alternative investments?

Alternative investments are assets that fall outside traditional asset classes, such as private equity, hedge funds, and collectibles. They can provide diversification and potential high returns but often come with higher risk and less liquidity.