Introduction

Exchange Traded Funds (ETFs) have become increasingly popular among investors due to their flexibility, diversity, and cost-efficiency. ETFs offer a way to invest in a wide range of assets, providing exposure to different sectors, markets, and investment strategies. Understanding the fundamentals of Exchange Traded Funds is essential for both new and seasoned investors looking to diversify their portfolios.

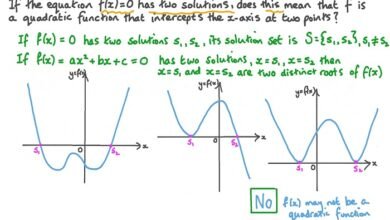

What Are Exchange Traded Funds?

Exchange Traded Funds (ETFs) are investment funds traded on stock exchanges, much like individual stocks. They are designed to track the performance of a specific index, sector, commodity, or other assets. By investing in ETFs, investors can gain exposure to a broad array of underlying assets without having to buy each individual component.

History and Evolution of Exchange Traded Funds

The first Exchange Traded Fund, the SPDR S&P 500 ETF, was introduced in 1993. Since then, the ETF market has grown exponentially, evolving to include various types of ETFs such as equity, fixed income, commodity, and sector-specific ETFs. This growth reflects the increasing demand for diverse investment options and the benefits that ETFs provide.

Benefits of Investing in Exchange Traded Funds

There are numerous benefits to investing in Exchange Traded Funds. ETFs offer diversification, as they include a variety of assets within a single fund. They are also cost-effective due to lower expense ratios compared to mutual funds. Additionally, ETFs provide liquidity, as they can be bought and sold on exchanges throughout the trading day, offering flexibility for investors.

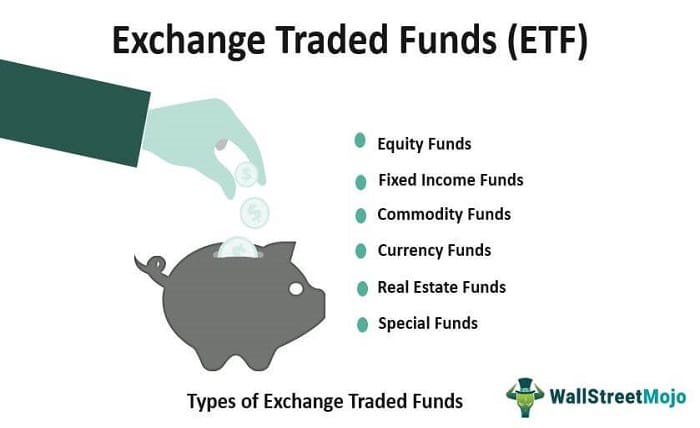

Types of Exchange Traded Funds

There are several types of Exchange Traded Funds to suit different investment strategies and goals. These include:

- Equity ETFs: Track stock indexes and provide exposure to specific markets or sectors.

- Fixed Income ETFs: Include bonds and other debt instruments, offering stability and income.

- Commodity ETFs: Invest in physical commodities like gold, oil, or agricultural products.

- Sector and Industry ETFs: Focus on specific sectors such as technology, healthcare, or finance.

- International ETFs: Provide exposure to global markets outside the investor’s home country.

How to Invest in Exchange Traded Funds

Investing in Exchange Traded Funds is straightforward. Investors can purchase ETFs through brokerage accounts, just like individual stocks. It’s essential to research and choose ETFs that align with your investment objectives, risk tolerance, and time horizon. Monitoring performance and rebalancing your portfolio periodically is also crucial for long-term success.

ETF Fees and Expenses

While Exchange Traded Funds are generally cost-effective, it’s important to understand the fees and expenses associated with them. These include management fees, which are typically lower than those of mutual funds, and trading costs incurred when buying or selling ETF shares. Being aware of these costs can help investors make informed decisions and maximize their returns.

Risks Associated with Exchange Traded Funds

Like all investments, Exchange Traded Funds come with risks. These include market risk, as the value of ETFs fluctuates with the underlying assets. Sector-specific ETFs may be more volatile due to their concentrated exposure. Additionally, tracking error, which occurs when an ETF’s performance diverges from its benchmark index, can impact returns. Understanding these risks is crucial for effective ETF investing.

Tax Efficiency of Exchange Traded Funds

Exchange Traded Funds are known for their tax efficiency. Due to their unique structure, ETFs typically generate fewer capital gains distributions compared to mutual funds. This means investors may face lower tax liabilities, enhancing the overall returns on their investments. Understanding the tax implications of ETF investments can help investors plan their portfolios more effectively.

Comparing ETFs and Mutual Funds

While both Exchange Traded Funds and mutual funds offer diversification, they have distinct differences. ETFs are traded on exchanges and offer intraday liquidity, while mutual funds are priced at the end of the trading day. ETFs generally have lower expense ratios and are more tax-efficient. However, mutual funds may offer advantages such as active management and automatic reinvestment of dividends. Comparing these two investment vehicles can help investors choose the best option for their needs.

Strategies for Building a Portfolio with Exchange Traded Funds

Building a diversified portfolio with Exchange Traded Funds involves several strategies. These include:

- Core-Satellite Strategy: Using broad-based ETFs as the core of the portfolio and adding specialized ETFs for enhanced returns.

- Sector Rotation: Shifting investments among different sectors based on economic cycles and market conditions.

- Income Generation: Incorporating fixed income and dividend-focused ETFs to generate steady income.

- Global Diversification: Investing in international ETFs to gain exposure to global markets and reduce reliance on domestic performance.

The Future of Exchange Traded Funds

The future of Exchange Traded Funds looks promising, with continued growth and innovation. The development of new ETF products, such as thematic ETFs focusing on trends like technology and sustainability, offers investors more opportunities. Additionally, advancements in fintech are making ETF investing more accessible. Staying informed about these trends can help investors leverage ETFs effectively in their portfolios.

Conclusion

Exchange Traded Funds have revolutionized the investment landscape, offering a flexible, cost-effective, and diversified approach to investing. By understanding the various types of ETFs, their benefits, risks, and strategies for building a portfolio, investors can make informed decisions and achieve their financial goals. As the ETF market continues to evolve, staying educated and adapting to new opportunities will be key to maximizing the potential of Exchange Traded Funds.

FAQs

1. What are Exchange Traded Funds (ETFs)?

Exchange Traded Funds (ETFs) are investment funds traded on stock exchanges that track the performance of a specific index, sector, commodity, or other assets.

2. How do ETFs differ from mutual funds?

ETFs are traded on exchanges and offer intraday liquidity, typically have lower expense ratios, and are more tax-efficient compared to mutual funds, which are priced at the end of the trading day and may offer active management.

3. What are the main types of ETFs?

The main types of ETFs include equity ETFs, fixed income ETFs, commodity ETFs, sector and industry ETFs, and international ETFs, each catering to different investment strategies and goals.

4. What are the risks associated with investing in ETFs?

Risks associated with ETFs include market risk, sector-specific volatility, and tracking error, which occurs when an ETF’s performance diverges from its benchmark index.

5. How can I start investing in ETFs?

To start investing in ETFs, open a brokerage account, research and choose ETFs that align with your investment objectives, and monitor performance while periodically rebalancing your portfolio.