Introduction

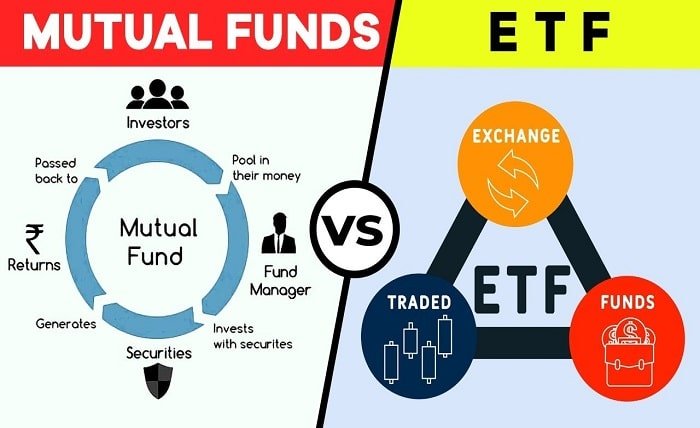

Investing in financial markets can be overwhelming, especially with the variety of options available, including mutual funds and ETFs. Both mutual funds and ETFs offer unique opportunities for investors to diversify their portfolios, but they operate differently. In this blog post, we’ll delve into the intricacies of mutual funds and ETFs, explaining what they are, how they work, and why they might be suitable for your investment strategy. Whether you’re a seasoned investor or just starting, understanding mutual funds and ETFs is crucial for making informed decisions.

What Are Mutual Funds?

Mutual funds are pooled investment vehicles where a fund manager collects money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. By investing in mutual funds, individuals can gain exposure to a broad range of assets, managed by professional fund managers. Mutual funds offer various types, including equity funds, bond funds, and balanced funds, each catering to different investment goals. The flexibility and professional management of mutual funds make them a popular choice for long-term investors.

What Are ETFs?

ETFs, or Exchange-Traded Funds, are similar to mutual funds in that they pool money from multiple investors to invest in a diversified portfolio. However, ETFs trade on stock exchanges like individual stocks, allowing investors to buy and sell shares throughout the trading day. This liquidity and ease of trading make ETFs an attractive option for investors looking for flexibility. ETFs typically track an index, such as the S&P 500, but they can also focus on specific sectors, commodities, or investment strategies. The combination of diversification and ease of trading has made ETFs a popular investment choice.

Mutual Funds vs. ETFs: Key Differences

While mutual funds and ETFs share some similarities, they differ in several key aspects. One of the most significant differences is how they are traded. Mutual funds are priced once a day at the net asset value (NAV) after the market closes, while ETFs can be traded throughout the day at market prices. Additionally, mutual funds often come with higher expense ratios due to active management, whereas ETFs generally have lower costs, especially if they track a passive index. Understanding these differences is essential for choosing between mutual funds and ETFs based on your investment strategy.

Costs and Fees: Mutual Funds vs. ETFs

The costs associated with mutual funds and ETFs are a crucial factor for investors. Mutual funds typically have higher expense ratios due to active management fees, administrative costs, and sometimes sales loads. On the other hand, ETFs usually have lower expense ratios because they are often passively managed and trade like stocks. However, ETFs may incur brokerage fees when buying or selling shares, which can add up depending on trading frequency. Evaluating the costs and fees of mutual funds and ETFs is vital for maximizing your investment returns.

Tax Implications of Mutual Funds and ETFs

Tax efficiency is another critical consideration when choosing between mutual funds and ETFs. Mutual funds can generate capital gains distributions that are passed on to investors, which may lead to unexpected tax liabilities. ETFs, however, are generally more tax-efficient due to their unique structure, which allows for in-kind redemptions. This process minimizes capital gains distributions, making ETFs more appealing to tax-sensitive investors. Understanding the tax implications of mutual funds and ETFs can help you manage your investment portfolio more effectively.

Performance and Returns: Mutual Funds vs. ETFs

The performance of mutual funds and ETFs varies depending on the underlying assets and the investment strategy. Actively managed mutual funds aim to outperform the market, but they may also come with higher risks and costs. In contrast, ETFs often track a specific index, providing market returns with lower costs. While some mutual funds may outperform ETFs in certain market conditions, the lower costs and broad diversification of ETFs can lead to comparable or better long-term returns. Analyzing the performance and returns of mutual funds and ETFs helps investors align their choices with their financial goals.

Diversification and Risk Management

Both mutual funds and ETFs offer diversification, but the degree and focus can differ. Mutual funds often provide access to a broader range of assets and can be tailored to specific investment strategies, such as growth or income. ETFs, while diversified within their respective indices, may focus on specific sectors or themes, offering targeted exposure. The choice between mutual funds and ETFs depends on your risk tolerance and investment objectives. By understanding the diversification and risk management aspects of mutual funds and ETFs, you can build a portfolio that meets your needs.

Liquidity and Accessibility

Liquidity is a critical factor when comparing mutual funds and ETFs. ETFs, being traded on exchanges, offer higher liquidity as they can be bought and sold throughout the trading day. Mutual funds, on the other hand, are less liquid since transactions occur at the end of the trading day at the NAV price. This difference in liquidity makes ETFs more suitable for investors who need flexibility and the ability to respond quickly to market changes. However, mutual funds may still be preferred by long-term investors who prioritize stability over liquidity. Understanding the liquidity and accessibility of mutual funds and ETFs can guide your investment decisions.

Choosing Between Mutual Funds and ETFs

The decision to invest in mutual funds or ETFs depends on various factors, including your investment goals, risk tolerance, and financial situation. If you prefer active management and are willing to pay higher fees for potential outperformance, mutual funds may be the right choice. On the other hand, if you value low costs, tax efficiency, and flexibility, ETFs might be more suitable. Additionally, your investment horizon and need for liquidity should influence your choice. By considering these factors, you can make an informed decision on whether mutual funds or ETFs align better with your investment strategy.

Combining Mutual Funds and ETFs in a Portfolio

For many investors, the best approach may be to combine mutual funds and ETFs in a diversified portfolio. This strategy allows you to benefit from the strengths of both investment vehicles. For instance, you could use mutual funds for specific asset classes that require active management, while leveraging ETFs for broad market exposure with lower costs. This combination can help you achieve a balanced portfolio that aligns with your risk tolerance and financial goals. Understanding how to integrate mutual funds and ETFs into a single portfolio is key to maximizing your investment potential.

The Future of Mutual Funds and ETFs

The landscape of mutual funds and ETFs is constantly evolving, with new products and strategies being introduced to meet the changing needs of investors. Technological advancements and increased investor demand for transparency and low costs are driving the growth of ETFs, while mutual funds continue to adapt by offering more targeted and specialized options. As the investment industry evolves, staying informed about trends and innovations in mutual funds and ETFs is crucial for making the most of your investment opportunities. By keeping an eye on the future of mutual funds and ETFs, you can position yourself for long-term success.

Conclusion

Mutual funds and ETFs are two of the most popular investment vehicles available to investors today. While they share some similarities, their differences in trading, costs, tax efficiency, and management style make them suitable for different types of investors. Whether you prefer the active management and broad diversification of mutual funds or the low costs and flexibility of ETFs, understanding these options is essential for building a successful investment portfolio. By carefully considering your financial goals, risk tolerance, and investment horizon, you can make informed decisions that align with your needs and help you achieve your financial objectives.

FAQs

1. What is the main difference between mutual funds and ETFs?

The main difference between mutual funds and ETFs is how they are traded. Mutual funds are priced once a day at the net asset value (NAV) after the market closes, while ETFs can be traded throughout the day at market prices.

2. Are ETFs more tax-efficient than mutual funds?

Yes, ETFs are generally more tax-efficient than mutual funds due to their unique structure, which allows for in-kind redemptions, minimizing capital gains distributions.

3. Which is better for long-term investment: mutual funds or ETFs?

Both mutual funds and ETFs can be suitable for long-term investment, depending on your goals and risk tolerance. Mutual funds offer active management, while ETFs provide low costs and flexibility.

4. Can I invest in both mutual funds and ETFs?

Yes, many investors choose to combine mutual funds and ETFs in their portfolios to benefit from the strengths of both investment vehicles, achieving diversification and cost-efficiency.

5. How do costs compare between mutual funds and ETFs?

Mutual funds typically have higher expense ratios due to active management fees, while ETFs usually have lower costs, especially if they track a passive index. However, ETFs may incur brokerage fees when trading.