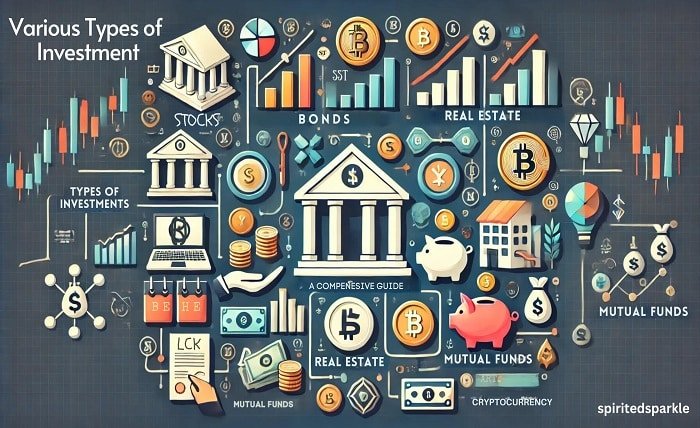

Various Investment Options: A Comprehensive Guide

Introduction

Investing is a crucial aspect of financial planning that allows individuals to grow their wealth over time. Understanding the different types of various investment options available is essential for making informed decisions that align with your financial goals. This comprehensive guide will explore the world of various investment opportunities, providing insights into how each option works, the potential risks and returns, and strategies for building a diversified portfolio.

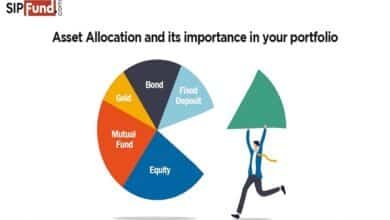

The Importance of Diversifying Investments

Diversification is a fundamental principle when considering various investment options. By spreading your investments across different asset classes, you can reduce risk and increase the potential for stable returns. This section will delve into the importance of diversification in various investment strategies, explaining how it can protect your portfolio from market volatility and economic downturns.

Stocks: A Popular Investment Option

Stocks are one of the most well-known and widely used various investment options. When you invest in stocks, you are buying shares of a company, which can appreciate in value over time. This section will cover the basics of investing in stocks, including how to choose the right companies, the benefits of long-term investment, and the risks associated with market fluctuations.

Bonds: A Safer Investment Choice

Bonds are another common type of various investment options, often considered safer than stocks. Bonds are essentially loans you give to a government or corporation in exchange for regular interest payments and the return of the principal amount at maturity. This section will explore the different types of bonds, such as government and corporate bonds, and explain how they can provide steady income with lower risk compared to stocks.

Mutual Funds and ETFs: Pooled Investment Vehicles

Mutual funds and exchange-traded funds (ETFs) are popular various investment options that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets. This section will discuss the advantages of investing in mutual funds and ETFs, including professional management, diversification, and ease of access for individual investors.

Real Estate: Tangible and Profitable Investment

Real estate is a tangible asset that offers a variety of various investment opportunities. Whether it’s residential, commercial, or industrial properties, real estate can provide steady rental income and potential for capital appreciation. This section will examine the different ways to invest in real estate, such as buying rental properties, investing in Real Estate Investment Trusts (REITs), or participating in real estate crowdfunding.

Commodities: Investing in Physical Assets

Commodities, such as gold, silver, oil, and agricultural products, are another form of various investment options that involve physical assets. Investing in commodities can serve as a hedge against inflation and provide portfolio diversification. This section will explain how to invest in commodities, the factors that influence commodity prices, and the potential risks and rewards of this investment class.

Cryptocurrencies: The New Age Investment

Cryptocurrencies have emerged as a new and exciting type of various investment options. Digital currencies like Bitcoin and Ethereum offer high potential returns but come with significant volatility and risk. This section will provide an overview of cryptocurrency investments, discussing how to buy and store digital assets, the importance of blockchain technology, and the risks involved in this rapidly evolving market.

Precious Metals: A Traditional Investment Option

Precious metals, such as gold and silver, have been used as a store of value for centuries. As a form of various investment options, precious metals are often seen as a safe haven during times of economic uncertainty. This section will explore the reasons to invest in precious metals, the different ways to buy them, and how they can fit into a diversified investment portfolio.

Alternative Investments: Exploring New Opportunities

Alternative investments include a broad range of various investment options outside traditional asset classes like stocks, bonds, and cash. This category can include hedge funds, private equity, venture capital, and even collectibles like art and wine. This section will discuss the unique characteristics of alternative investments, their potential for high returns, and the risks associated with these often illiquid and complex assets.

Risk Management in Various Investments

Understanding and managing risk is a critical aspect of investing in various investment options. Different investments carry different levels of risk, and it’s important to align your investment choices with your risk tolerance and financial goals. This section will provide strategies for managing risk across various investments, including asset allocation, diversification, and the use of hedging techniques.

The Role of Financial Advisors in Various Investments

Working with a financial advisor can be beneficial when navigating the complexities of various investment options. Financial advisors can provide personalized advice, help you create a diversified portfolio, and guide you through market fluctuations. This section will explain the role of financial advisors in investment planning, how to choose a reputable advisor, and the benefits of having professional support in achieving your financial goals.

Conclusion

In conclusion, understanding and exploring various investment options is essential for building a balanced and diversified portfolio that can withstand market volatility and achieve long-term financial success. Whether you prefer traditional investments like stocks and bonds, tangible assets like real estate and commodities, or new-age options like cryptocurrencies, it’s important to consider your risk tolerance, financial goals, and investment horizon. By carefully selecting and managing your various investments, you can grow your wealth and secure your financial future.

FAQs

1. What are the main types of various investment options?

The main types of various investment options include stocks, bonds, mutual funds, ETFs, real estate, commodities, cryptocurrencies, precious metals, and alternative investments.

2. How do I choose the right various investment options for my portfolio?

Choosing the right various investment options depends on your financial goals, risk tolerance, investment horizon, and the level of diversification you want to achieve.

3. Are various investment options suitable for beginners?

Yes, various investment options are suitable for beginners, especially when starting with safer investments like bonds, mutual funds, or ETFs, and gradually exploring more complex options as you gain experience.

4. How can I manage risk when investing in various options?

You can manage risk by diversifying your investments, aligning your choices with your risk tolerance, and seeking professional advice from a financial advisor.

5. Can alternative investments provide high returns compared to traditional options?

Alternative investments can potentially provide high returns, but they often come with higher risk and less liquidity compared to traditional investment options.