Stock Market: Insights and Strategies for Investors

Introduction

The stock market is a complex and fascinating world where fortunes can be made or lost in the blink of an eye. Understanding the intricacies of stock market operations is crucial for anyone looking to invest wisely and maximize their financial potential. This blog post aims to demystify the stock market, providing readers with a solid foundation of knowledge and practical strategies to navigate the market effectively.

Stock Market

The stock market operates on the fundamental principles of supply and demand. Stocks are shares of ownership in a company, and the stock market is the place where stocks are bought and sold. Knowing the key components such as stocks, bonds, and mutual funds, and how they work, sets the stage for making informed investment decisions.

The Role of Major Stock Exchanges

Stock exchanges, like the New York Stock Exchange (NYSE) and the NASDAQ, play a pivotal role in the economic landscape. They facilitate the buying and selling of stocks and other securities, which helps companies raise capital and provides investors with opportunities to gain returns on their investments.

Analyzing Market Trends

To succeed in the stock market, investors must understand how to analyze market trends. This involves looking at market indicators, understanding economic factors, and using technical analysis to predict future movements. Regularly engaging with market analysis can significantly enhance an investor’s ability to make informed decisions.

The Impact of Economic Indicators

Economic indicators such as GDP growth rates, unemployment figures, and inflation rates directly impact the stock market. These indicators can provide clues about the health of the economy and potential market directions, aiding investors in strategizing their next moves.

Stock Market Strategies for Beginners

For those new to the stock market, starting with basic investment strategies is key. This includes understanding the importance of diversification, the basics of buying low and selling high, and setting clear investment goals. These strategies form the backbone of successful stock market investing.

Advanced Trading Techniques

For the more seasoned investor, advanced trading techniques such as options trading, short selling, and using leverage can be powerful tools. However, these techniques carry higher risks and require a good understanding of market mechanics.

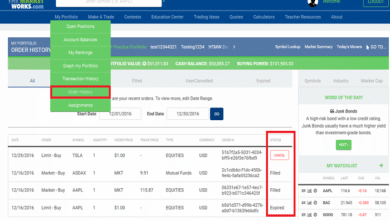

The Role of Brokerage Firms

Brokerage firms are essential facilitators in the stock market. They provide the platforms and tools needed for trading and can offer valuable advice and research. Choosing the right brokerage is crucial for effective trading and investment management.

Mitigating Risks in Stock Market Investments

Investing in the stock market involves risks, but there are strategies to mitigate them. This section covers risk management techniques such as stop-loss orders, hedging, and the importance of a well-balanced portfolio.

The Psychological Aspects of Trading

Successful trading isn’t just about strategies and knowledge; it’s also about understanding the psychological aspects. Emotional discipline, patience, and the ability to remain calm under pressure are critical traits of successful stock market traders.

Keeping Up with Changes in the Stock Market

The stock market is dynamic and ever-changing. Staying informed about new laws, regulations, and technological advancements can help investors adapt and maintain a competitive edge in the market.

Conclusion

The stock market offers numerous opportunities for growth and financial gains. By understanding the basics, staying informed about market trends, and employing sound investment strategies, individuals can significantly improve their chances of success. Remember, while the stock market can offer substantial rewards, it’s important to approach investing with caution and thorough research.

FAQs

1.What is the best way to start investing in the stock market?

Begin with a clear understanding of your financial goals, risk tolerance, and a basic knowledge of stock market operations. Starting with mutual funds or index funds can be a good way for beginners to get involved.

2.How important is diversification in stock market investing?

Diversification is crucial as it helps to spread risk across different investment types, sectors, and geographical locations, which can protect against significant losses.

3.Can economic downturns present opportunities in the stock market?

Yes, economic downturns can present buying opportunities for undervalued stocks. However, it’s important to conduct thorough research and consider long-term potential.

4.What are some common mistakes beginners make in the stock market?

Common mistakes include investing without a plan, letting emotions guide decisions, and failing to diversify investments.

5.How can I stay updated on stock market trends?

Regularly follow financial news, subscribe to stock market analysis channels, and use tools provided by brokerage platforms to keep a pulse on the market dynamics.