Investment Strategies: Building Wealth for the Future

Introduction

Investment strategies are essential for anyone looking to build wealth and secure their financial future. Whether you’re a seasoned investor or just starting, understanding the different approaches to investing can help you make informed decisions and achieve your financial goals. This comprehensive guide covers a wide range of investment strategies, providing valuable insights to help you navigate the complex world of investing.

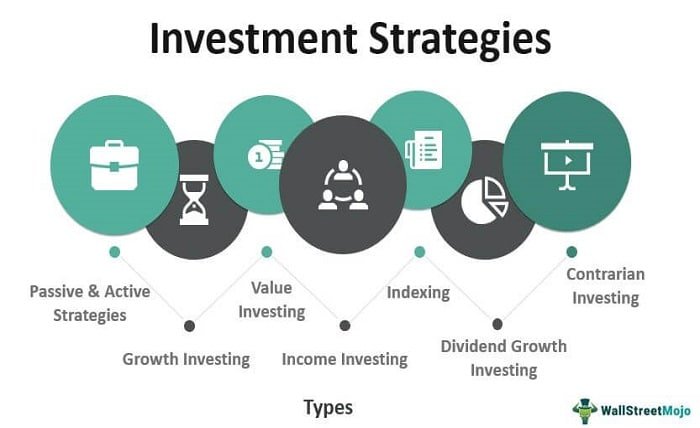

Investment Strategies

Investment strategies refer to the various approaches and methods investors use to achieve their financial goals. These strategies can range from conservative to aggressive, depending on the investor’s risk tolerance, time horizon, and financial objectives. By understanding the different types of investment strategies, you can choose the one that best suits your needs and goals.

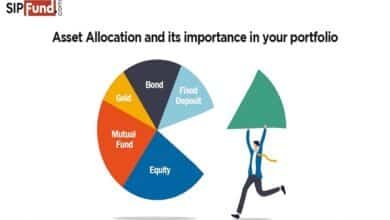

Importance of Diversification

Diversification is a fundamental investment strategy that involves spreading your investments across various asset classes to reduce risk. By diversifying your portfolio, you can protect yourself from significant losses if one investment performs poorly. This strategy helps to balance risk and reward, ensuring that your overall investment portfolio remains stable.

Risk Tolerance and Investment Strategies

Your risk tolerance plays a crucial role in determining the right investment strategies for you. Risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. Investors with high risk tolerance may opt for aggressive investment strategies, while those with low risk tolerance may prefer more conservative approaches.

Short-term vs. Long-term Investment Strategies

Investment strategies can be categorized into short-term and long-term approaches. Short-term strategies focus on achieving quick gains within a short period, while long-term strategies aim to build wealth over several years or decades. Understanding the differences between these strategies can help you choose the right approach based on your financial goals and time horizon.

Value Investing

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic value. This approach, popularized by investors like Warren Buffett, focuses on identifying undervalued companies with strong fundamentals. Value investing requires thorough research and analysis to find opportunities that offer significant potential for growth.

Growth Investing

Growth investing is an investment strategy that focuses on investing in companies that exhibit signs of above-average growth, even if the stock price appears expensive. Investors using this strategy seek out companies with strong earnings growth potential, often in emerging industries. Growth investing can be more volatile but offers the potential for substantial returns.

Income Investing

Income investing is an investment strategy centered on generating regular income from your investments. This approach typically involves investing in dividend-paying stocks, bonds, and other income-generating assets. Income investing is popular among retirees and those seeking a steady cash flow to supplement their income.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves regularly investing a fixed amount of money into a particular investment, regardless of the market’s condition. This approach reduces the impact of market volatility by spreading out your investments over time. Dollar-cost averaging is a disciplined investment strategy that can help mitigate the risk of making large investments during market highs.

Index Fund Investing

Index fund investing is a passive investment strategy that involves investing in index funds, which track the performance of a specific market index. This approach offers broad market exposure, low fees, and simplicity. Index fund investing is ideal for investors seeking a low-cost, diversified, and hands-off investment strategy.

Real Estate Investment Strategies

Real estate investment strategies involve investing in properties to generate rental income, capital appreciation, or both. This approach can include residential, commercial, and industrial properties. Real estate investing offers the potential for significant returns and diversification but requires substantial capital and active management.

Tax-Efficient Investing

Tax-efficient investing is an investment strategy focused on minimizing taxes on your investment returns. This approach involves using tax-advantaged accounts, such as IRAs and 401(k)s, and selecting investments that offer favorable tax treatment. Tax-efficient investing can help you retain more of your investment gains and achieve your financial goals more quickly.

Impact Investing

Impact investing is an investment strategy that aims to generate positive social and environmental impact alongside financial returns. Investors using this approach seek out companies and projects that align with their values and contribute to societal good. Impact investing allows you to support causes you care about while still achieving your financial objectives.

Conclusion

Investment strategies are crucial for building wealth and achieving your financial goals. By understanding the different approaches, such as diversification, value investing, growth investing, and income investing, you can create a well-rounded investment plan tailored to your needs. Whether you’re aiming for short-term gains or long-term growth, choosing the right investment strategy is key to your success.

FAQs

1. What is the best investment strategy for beginners?

For beginners, a diversified portfolio with a mix of index funds and bonds is a good starting point. This approach offers low risk and steady growth.

2. How do I determine my risk tolerance?

Assess your risk tolerance by considering your financial goals, investment time horizon, and comfort with market fluctuations. Consulting with a financial advisor can also help.

3. What is the difference between value investing and growth investing?

Value investing focuses on undervalued stocks with strong fundamentals, while growth investing targets companies with high earnings growth potential, often at higher valuations.

4. Can I combine multiple investment strategies?

Yes, combining multiple investment strategies can create a balanced portfolio that aligns with your risk tolerance and financial goals. Diversification is key to managing risk.

5. How can I make my investments more tax-efficient?

Use tax-advantaged accounts, such as IRAs and 401(k)s, and choose investments with favorable tax treatment, like index funds or tax-efficient mutual funds, to minimize taxes on returns.