Investment Accounts

Introduction

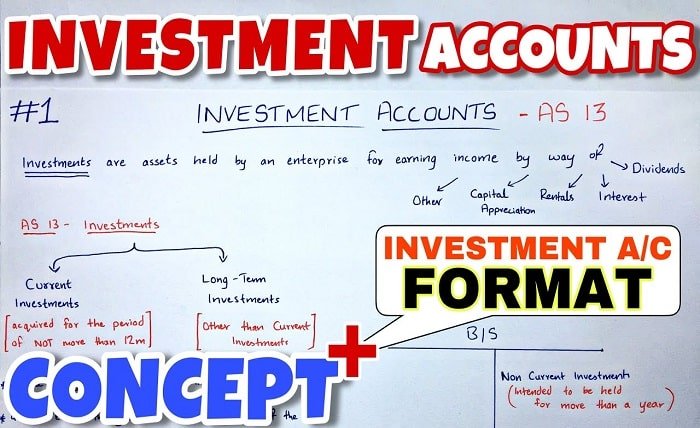

An investment account is a fundamental tool for anyone looking to grow their wealth. By using an investment account, individuals can buy, sell, and hold various types of investments such as stocks, bonds, mutual funds, and ETFs. Understanding the nuances of an investment account is crucial for making informed financial decisions that align with your goals.

Types of Investment Accounts

There are several types of investment accounts, each serving different purposes and offering unique benefits. Common types include individual brokerage accounts, retirement accounts (like IRAs and 401(k)s), and education savings accounts (such as 529 plans). Knowing which investment account suits your needs is the first step in building a successful portfolio.

Individual Brokerage Accounts

An individual brokerage account is one of the most versatile types of investment accounts. It allows you to trade a wide range of securities including stocks, bonds, and mutual funds. Unlike retirement accounts, an individual brokerage account offers no tax advantages, but it provides greater flexibility and accessibility for investors.

Retirement Accounts: IRAs and 401(k)s

Retirement accounts like Individual Retirement Accounts (IRAs) and 401(k)s are specifically designed to help individuals save for retirement. These investment accounts offer significant tax benefits, such as tax-deferred growth or tax-free withdrawals, depending on the type of account. Contributing to a retirement account is essential for long-term financial security.

Education Savings Accounts: 529 Plans

Education savings accounts, particularly 529 plans, are tailored to help families save for future education costs. Contributions to a 529 plan grow tax-free, and withdrawals for qualified education expenses are also tax-free. These investment accounts are valuable for parents planning to fund their children’s education while minimizing tax liabilities.

Taxable vs. Tax-Advantaged Investment Accounts

Understanding the distinction between taxable and tax-advantaged investment accounts is crucial for effective financial planning. Taxable accounts, such as individual brokerage accounts, incur taxes on dividends, interest, and capital gains. Conversely, tax-advantaged accounts like IRAs and 401(k)s provide tax benefits that enhance the growth of your investments.

Choosing the Right Investment Account

Selecting the right investment account depends on your financial goals, time horizon, and tax considerations. For retirement savings, tax-advantaged accounts like IRAs and 401(k)s are ideal. For more flexible investment opportunities, an individual brokerage account may be preferable. Evaluating your specific needs will guide you to the appropriate investment account.

Opening an Investment Account

Opening an investment account involves choosing a brokerage firm, completing an application, and funding the account. Many brokers offer online account setup, simplifying the process. It’s important to compare brokerage firms to find one that offers the features, fees, and services that best match your investment strategy.

Funding Your Investment Account

After opening your investment account, funding it is the next step. This can be done through direct deposits, wire transfers, or by transferring assets from another account. Regular contributions, whether automated or manual, are key to growing your investment account and achieving your financial goals.

Diversifying Your Investments

Diversification is a cornerstone of effective investing. By spreading your investments across various asset classes such as stocks, bonds, and mutual funds, you can reduce risk and enhance potential returns. A well-diversified investment account helps mitigate the impact of market volatility on your portfolio.

Monitoring and Managing Your Investment Account

Active management of your investment account is essential for success. This involves regularly reviewing your portfolio, rebalancing asset allocations, and staying informed about market trends. Many brokerage firms provide tools and resources to help you monitor and manage your investment account effectively.

Benefits of Investment Accounts

Investment accounts offer numerous benefits, including the potential for capital appreciation, dividend income, and tax advantages. These accounts provide a structured way to save and grow wealth, helping individuals meet long-term financial objectives such as retirement and education funding.

Common Mistakes to Avoid with Investment Accounts

Avoiding common mistakes is vital for effective investment management. Common pitfalls include insufficient diversification, ignoring tax implications, making emotional decisions, and neglecting regular portfolio reviews. Awareness of these mistakes can help you manage your investment account more successfully.

Conclusion

Investment accounts are essential tools for building and growing wealth. By understanding the different types of accounts, their benefits, and effective management strategies, you can make informed decisions that align with your financial goals. Whether saving for retirement, education, or other long-term objectives, the right investment account can help you achieve financial success.

FAQs

1. What is an investment account?

An investment account is a financial account that allows individuals to buy, sell, and hold various types of investments, such as stocks, bonds, and mutual funds.

2. How do I choose the right investment account?

Choosing the right investment account depends on your financial goals, time horizon, and tax considerations. Evaluate your needs to select the appropriate account type.

3. What are the benefits of a retirement investment account?

Retirement investment accounts like IRAs and 401(k)s offer tax advantages that enhance the growth of your investments, providing financial security during retirement.

4. How can I fund my investment account?

You can fund your investment account through direct deposits, wire transfers, or transferring assets from another account. Regular contributions are key to growth.

5. Why is diversification important in an investment account?

Diversification reduces risk and enhances potential returns by spreading investments across various asset classes, mitigating the impact of market volatility on your portfolio.