Invest Money Online: Strategies, Platforms, and Tips

Introduction

Investing money online has revolutionized the way people grow their wealth. With numerous platforms and strategies available, anyone can start their investment journey from the comfort of their home. This guide will provide you with essential knowledge on how to invest money online, including the best platforms, strategies, and tips for success.

Online Investing

Online investing refers to the process of using internet-based platforms to buy and sell financial assets such as stocks, bonds, mutual funds, ETFs, and more. It has democratized access to financial markets, allowing individuals to manage their portfolios with ease and transparency. Understanding the basics of online investing is crucial for making informed decisions.

Benefits of Investing Money Online

Invest money online offers numerous advantages. Firstly, it provides convenience, allowing you to manage your investments from anywhere. Additionally, online platforms often have lower fees compared to traditional brokers. They also offer a wide range of investment options and educational resources to help you make informed decisions.

Risks of Online Investing

While investing money online has its benefits, it also comes with risks. Market volatility, cyber security threats, and the potential for investment scams are some of the risks investors face. Understanding these risks and learning how to mitigate them is essential for protecting your investments.

Popular Online Investment Platforms

Several online platforms have gained popularity for their ease of use and robust features. Some of the most well-known platforms include Robinhood, E*TRADE, TD Ameritrade, and Fidelity. Each platform offers unique features and benefits, making it important to choose one that aligns with your investment goals and preferences.

Choosing the Right Online Investment Platform

Selecting the right online investment platform depends on several factors, including fees, investment options, user interface, and customer support. It’s essential to compare different platforms and read reviews to determine which one best suits your needs. Investing time in choosing the right platform can enhance your overall investment experience.

Creating an Investment Strategy

A well-defined investment strategy is crucial for achieving your financial goals. This involves determining your risk tolerance, investment horizon, and financial objectives. Whether you prefer a conservative, moderate, or aggressive approach, having a strategy helps guide your investment decisions and manage risks effectively.

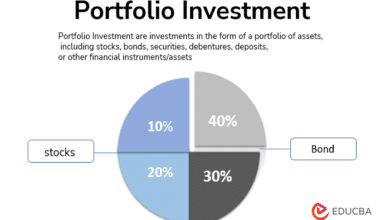

Diversifying Your Online Investments

Diversification is a key principle of investing, helping to spread risk across various assets. By diversifying your online investments, you can reduce the impact of market volatility on your portfolio. This can be achieved by investing in a mix of stocks, bonds, real estate, and other asset classes.

Fees and Costs

When invest money online, it’s important to be aware of the fees and costs associated with different platforms and investment products. These can include trading fees, account maintenance fees, and expense ratios for mutual funds and ETFs. Understanding these costs helps you make more cost-effective investment choices.

Utilizing Educational Resources

Many online investment platforms offer a wealth of educational resources, including articles, webinars, and tutorials. Utilizing these resources can enhance your investment knowledge and help you stay informed about market trends and investment strategies. Continuous learning is vital for successful online investing.

Staying Informed with Market News

Keeping up with market news and financial updates is crucial for making informed investment decisions. Many online platforms provide news feeds, market analysis, and research reports to help investors stay updated. Staying informed allows you to react promptly to market changes and opportunities.

Monitoring and Adjusting Your Portfolio

Regularly monitoring and adjusting your portfolio is essential for ensuring it remains aligned with your financial goals. This involves reviewing your investments, assessing performance, and making necessary adjustments based on market conditions and your changing financial situation. Consistent portfolio management helps maintain a balanced and diversified investment strategy.

The Future of Online Investing

The landscape of online investing is continuously evolving with advancements in technology. Innovations such as robo-advisors, AI-driven analytics, and blockchain technology are shaping the future of online investing. Staying updated on these trends can help you leverage new tools and opportunities for better investment outcomes.

Conclusion

Investing money online offers numerous opportunities for growing your wealth. By understanding the basics, choosing the right platforms, and employing effective strategies, you can navigate the online investment landscape successfully. Remember to stay informed, diversify your portfolio, and continuously educate yourself to achieve your financial goals.

FAQs

1. What is online investing?

Online investing refers to the process of using internet-based platforms to buy and sell financial assets such as stocks, bonds, and mutual funds.

2. What are the benefits of investing money online?

Benefits include convenience, lower fees, a wide range of investment options, and access to educational resources.

3. What are the risks of online investing?

Risks include market volatility, cyber security threats, and the potential for investment scams.

4. How do I choose the right online investment platform?

Consider factors such as fees, investment options, user interface, and customer support when choosing an online investment platform.

5. Why is diversification important in online investing?

Diversification helps spread risk across various assets, reducing the impact of market volatility on your portfolio.