How to Start a Forex Brokerage: A Comprehensive Guide

Introduction

Starting a Forex brokerage can be a highly profitable venture for those with a passion for the financial markets and a strong understanding of regulatory requirements. This detailed guide will walk you through the steps to establish your own Forex brokerage, discussing everything from the initial setup and licensing to technology integration and marketing strategies. By the end of this post, you’ll be equipped with the knowledge to launch a successful Forex trading platform.

The Forex Market

Before you start a Forex brokerage, it’s essential to understand the market’s intricacies. Forex, or foreign exchange, involves trading currencies and is the largest financial market globally. Knowing the dynamics of how currencies are traded, the major players, and what influences currency fluctuations will lay a solid foundation for your brokerage.

Developing a Business Plan

A well-structured business plan is crucial when you start a Forex brokerage. This plan should outline your business goals, target market, competitive analysis, marketing strategies, and financial projections. A robust business plan not only guides your strategic decisions but also is vital for attracting investors and partners.

Choosing the Right Jurisdiction

The location from which you operate your Forex brokerage can significantly impact your regulatory obligations and business operations. Some jurisdictions offer more favorable conditions, including tax benefits and more straightforward licensing processes. Research and select a jurisdiction that aligns with your business goals and compliance capabilities.

Navigating Licensing Requirements

To start a Forex brokerage, you must obtain the necessary licenses from relevant financial authorities. Licensing requirements can vary significantly between jurisdictions and are critical to operate legally. This process can be complex and lengthy, so consider hiring legal experts specialized in financial services.

Securing Initial Capital

Starting a Forex brokerage requires a considerable amount of capital. This capital will cover licensing fees, software acquisition, staffing, and other operational costs. Secure sufficient funding to ensure smooth operations from the start. Explore options like venture capital, loans, or private investors.

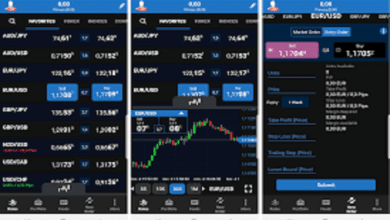

Choosing Technology Partners

The backbone of a Forex brokerage is its trading platform. Choose technology partners that offer robust, scalable, and secure trading solutions. Consider platforms like MetaTrader or develop a proprietary platform. Additionally, integrate other essential tools like CRM systems, payment processors, and cybersecurity measures.

Setting Up Your Website

Your website is the first point of contact for potential clients. Ensure that it is professionally designed to provide excellent user experience and optimized for conversions. Include features like live chat, educational resources, and easy navigation to enhance client engagement.

Implementing Risk Management Strategies

Effective risk management is critical to safeguard your brokerage and your clients’ interests. Implement strategies such as leverage limits, margin requirements, and stop-loss orders to manage risk. Regularly review and adjust these strategies to align with market conditions and regulatory changes.

Marketing Your Forex Brokerage

Develop a comprehensive marketing strategy to attract and retain clients. Utilize digital marketing tactics such as SEO, PPC, content marketing, and social media campaigns. Focus on building a strong brand and establishing credibility in the Forex community.

Hiring the Right Team

To run a successful Forex brokerage, you need a team of experienced professionals. Hire staff who are knowledgeable in Forex trading, regulatory compliance, customer service, and technology. Investing in the right team will enhance your brokerage’s efficiency and reputation.

Offering Competitive Trading Conditions

To attract traders, your brokerage should offer competitive trading conditions. This includes tight spreads, low commissions, fast execution speeds, and a variety of trading instruments. Keep an eye on market trends and competitor offerings to stay competitive.

Continuously Improving and Innovating

The Forex market is constantly evolving. Stay ahead by continuously improving your services and innovating new solutions. Regularly update your technology, expand your instrument offerings, and enhance your trading conditions to meet the changing needs of traders.

Conclusion

Starting a Forex brokerage can be challenging but rewarding. By understanding the market, meeting regulatory requirements, leveraging technology, and implementing effective marketing strategies, you can establish a successful Forex trading business. Remember, continuous improvement and adaptation to market changes are key to sustaining long-term success.

FAQs

1. How much capital do I need to start a Forex brokerage?

The initial capital required to start a Forex brokerage can vary widely depending on the jurisdiction and scale of operations, typically ranging from $100,000 to several million dollars.

2. What is the best platform for a Forex brokerage?

MetaTrader 4 and MetaTrader 5 are among the most popular and widely accepted trading platforms. However, some brokerages choose to develop their own proprietary platforms to differentiate themselves from competitors.

3. How do I ensure my Forex brokerage complies with regulations?

It’s crucial to understand and adhere to the regulatory framework of the jurisdiction in which you operate. Hiring a legal advisor with expertise in financial regulations is highly recommended.

4. What are the key features my Forex brokerage website should have?

A professional Forex brokerage website should offer clear information about your services, easy account registration processes, educational resources, and effective customer support channels.

5. Can I start a Forex brokerage without a physical office?

Yes, it is possible to start a Forex brokerage with a virtual office, especially if you leverage technology and cloud-based services. However, some jurisdictions may require a physical presence for regulatory purposes.