Introduction

Securing your financial future is a crucial aspect of personal and professional life. Whether you’re just starting your career or planning for retirement, having a clear financial plan can provide peace of mind and stability. This comprehensive guide will cover essential strategies, tips, and insights to help you build a secure financial future.

Your Current Financial Situation

To secure your financial future, it’s essential to first understand your current financial situation. This involves assessing your income, expenses, debts, and savings. By having a clear picture of your finances, you can identify areas for improvement and set realistic financial goals for the future.

Setting Financial Goals

Setting financial goals is a critical step toward securing your financial future. These goals can include short-term objectives like paying off debt and long-term goals like saving for retirement or buying a home. Clearly defined goals provide direction and motivation, helping you stay focused on your financial future.

Creating a Budget

A well-structured budget is a foundational tool for securing your financial future. A budget helps you manage your income and expenses effectively, ensuring you live within your means and save for future needs. Regularly reviewing and adjusting your budget can help you stay on track toward achieving your financial goals.

Building an Emergency Fund

An emergency fund is a vital component of a secure financial future. This fund provides a financial cushion for unexpected expenses, such as medical emergencies or job loss. Aim to save three to six months’ worth of living expenses to protect your financial future from unforeseen events.

Reducing and Managing Debt

Managing and reducing debt is essential for a healthy financial future. High-interest debt can quickly derail your financial plans, so it’s crucial to prioritize paying off debts. Strategies such as debt consolidation or the snowball method can help you reduce debt more efficiently and secure your financial future.

Investing for the Future

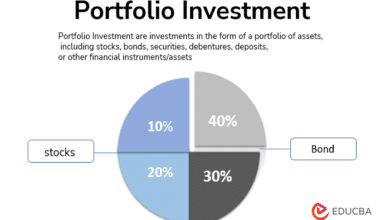

Investing is a powerful way to grow your wealth and secure your financial future. Diversifying your investments across different asset classes, such as stocks, bonds, and real estate, can help you achieve higher returns while mitigating risk. Understanding the basics of investing and seeking professional advice can significantly impact your financial future.

Retirement Planning

Planning for retirement is a crucial aspect of securing your financial future. Start by estimating your retirement needs and exploring different retirement savings options, such as 401(k) plans, IRAs, and pension plans. The earlier you start saving for retirement, the more secure your financial future will be.

Importance of Insurance

Insurance plays a critical role in protecting your financial future. Health insurance, life insurance, and disability insurance provide financial security in case of unexpected events. Reviewing your insurance coverage regularly ensures that you and your loved ones are adequately protected.

Estate Planning

Estate planning is essential for securing your financial future and ensuring your assets are distributed according to your wishes. This involves creating a will, setting up trusts, and designating beneficiaries. Proper estate planning can also help minimize taxes and legal complications for your heirs.

Continuous Financial Education

Staying informed about financial trends and continuously educating yourself is key to securing your financial future. Financial literacy empowers you to make informed decisions and adapt to changing economic conditions. Resources such as books, courses, and financial advisors can enhance your financial knowledge.

Avoiding Common Financial Pitfalls

Avoiding common financial pitfalls is crucial for a secure financial future. These pitfalls include overspending, neglecting savings, and making impulsive investment decisions. Being aware of these risks and developing good financial habits can help you avoid setbacks and stay on course toward your financial goals.

Monitoring and Adjusting Your Financial Plan

Regularly monitoring and adjusting your financial plan is essential to ensure it remains aligned with your goals. Life changes, such as marriage, children, or career shifts, can impact your financial future. Periodically reviewing your plan allows you to make necessary adjustments and stay on track.

Conclusion

Securing your financial future requires a proactive and disciplined approach. By understanding your current financial situation, setting clear goals, creating a budget, and making informed investment decisions, you can build a stable and prosperous financial future. Continuous education and regular review of your financial plan will ensure you remain on the path to financial security.

FAQs

1. What is the first step to securing my financial future?

The first step to securing your financial future is understanding your current financial situation, which involves assessing your income, expenses, debts, and savings.

2. How much should I save in an emergency fund?

It is recommended to save three to six months’ worth of living expenses in an emergency fund to protect your financial future from unforeseen events.

3. What are some effective strategies for reducing debt?

Effective strategies for reducing debt include debt consolidation, the snowball method (paying off smallest debts first), and prioritizing high-interest debt to secure your financial future.

4. Why is retirement planning important for my financial future?

Retirement planning is crucial for ensuring you have enough savings to maintain your lifestyle in retirement, contributing significantly to a secure financial future.

5. How often should I review and adjust my financial plan?

You should review and adjust your financial plan at least annually or whenever you experience significant life changes to ensure it remains aligned with your financial goals and future.