Dollar Cost Averaging: A Strategic Guide for Smart Investing

Introduction

Dollar Cost Averaging (DCA) is an investment strategy that involves regularly investing a fixed amount of money into a particular asset, regardless of its price. By doing so, investors buy more shares when prices are low and fewer shares when prices are high, which can help mitigate the impact of volatility. Understanding dollar cost averaging is crucial for anyone looking to make disciplined, long-term investments.

The Basics of Dollar Cost Averaging

At its core, dollar cost averaging involves setting a fixed schedule for purchasing a specific amount of an investment, such as stocks, bonds, or mutual funds. This method spreads out investment costs over time, potentially reducing the risks associated with lump-sum investments. By consistently investing, regardless of market conditions, dollar cost averaging can help build a robust investment portfolio.

Advantages of Dollar Cost Averaging

One of the primary advantages of dollar cost averaging is its simplicity and ease of implementation. Investors do not need to worry about timing the market, as investments are made automatically at regular intervals. This approach can also reduce the emotional impact of market fluctuations, making it easier to stick to a long-term investment plan. Additionally, dollar cost averaging can help smooth out the effects of market volatility over time.

How Dollar Cost Averaging Mitigates Risk

Dollar cost averaging mitigates risk by spreading investments over time, reducing the impact of market volatility on a portfolio. When markets are down, the same fixed investment buys more shares, potentially leading to greater gains when prices recover. Conversely, when markets are up, the fixed investment buys fewer shares, helping to avoid overexposure at higher prices. This balanced approach can lead to a more stable investment performance.

Implementing Dollar Cost Averaging

Implementing dollar cost averaging involves selecting the asset or assets to invest in, determining the fixed amount to invest regularly, and setting a consistent investment schedule. Investors can automate this process through brokerage accounts or investment apps that support recurring investments. Monitoring the performance of the investments over time can help ensure that the dollar cost averaging strategy aligns with financial goals.

Dollar Cost Averaging vs. Lump-Sum Investing

Comparing dollar cost averaging with lump-sum investing highlights the benefits and drawbacks of each approach. Lump-sum investing involves putting a large amount of money into an investment all at once, which can lead to significant gains if the market rises but also substantial losses if the market falls. Dollar cost averaging, on the other hand, reduces the risk of market timing and provides a more measured approach to building a portfolio.

Historical Performance of Dollar Cost Averaging

Historically, dollar cost averaging has proven to be an effective strategy for long-term investors. By investing consistently over time, investors can benefit from compound interest and potential market recoveries. Historical data shows that dollar cost averaging can help smooth out returns and reduce the impact of short-term market volatility, making it a viable strategy for those seeking steady, long-term growth.

Psychological Benefits of Dollar Cost Averaging

The psychological benefits of dollar cost averaging cannot be overlooked. This strategy helps reduce the anxiety and stress associated with market fluctuations, as investors do not need to worry about timing their investments perfectly. By following a disciplined investment schedule, investors can focus on their long-term goals rather than short-term market movements, leading to a more relaxed and confident investment experience.

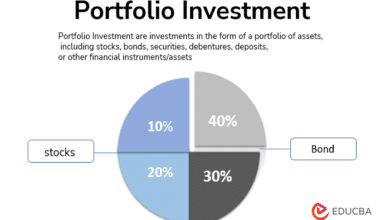

Suitable Investments for Dollar Cost Averaging

Dollar cost averaging is suitable for a wide range of investments, including stocks, mutual funds, ETFs, and even cryptocurrencies. The key is to choose investments that align with your financial goals and risk tolerance. Diversifying across different asset classes can further enhance the benefits of dollar cost averaging, providing a balanced approach to building wealth over time.

Dollar Cost Averaging in Retirement Accounts

Dollar cost averaging is particularly effective in retirement accounts, such as 401(k)s and IRAs. Regular contributions to these accounts, often facilitated by payroll deductions, naturally lend themselves to a dollar cost averaging approach. This consistent investment strategy can help build a substantial retirement nest egg, benefiting from compound growth and market recoveries over the long term.

Challenges and Limitations of Dollar Cost Averaging

Despite its many advantages, dollar cost averaging is not without its challenges and limitations. One potential drawback is that it may lead to suboptimal returns in a steadily rising market, as investors could miss out on the full benefits of an early lump-sum investment. Additionally, dollar cost averaging requires discipline and commitment to a regular investment schedule, which may be challenging for some investors to maintain.

Conclusion

Dollar cost averaging is a powerful investment strategy that offers simplicity, risk mitigation, and psychological benefits. By regularly investing a fixed amount, investors can build a diversified portfolio and achieve long-term financial goals without the stress of market timing. Understanding and implementing dollar cost averaging can lead to a more disciplined, confident, and successful investment journey.

FAQs

1. What is the main advantage of dollar cost averaging?

The main advantage of dollar cost averaging is that it reduces the risk of market timing and helps investors build a portfolio over time, smoothing out the effects of market volatility.

2. Can dollar cost averaging be used for all types of investments?

Yes, dollar cost averaging can be applied to a wide range of investments, including stocks, mutual funds, ETFs, and even cryptocurrencies.

3. How does dollar cost averaging help mitigate risk?

Dollar cost averaging spreads investments over time, buying more shares when prices are low and fewer shares when prices are high, reducing the impact of market fluctuations.

4. Is dollar cost averaging suitable for retirement accounts?

Absolutely. Dollar cost averaging is particularly effective in retirement accounts, such as 401(k)s and IRAs, due to regular contributions and long-term investment horizons.

5. What are the challenges of dollar cost averaging?

Challenges include potentially lower returns in a rising market and the need for discipline to maintain a regular investment schedule. However, the benefits often outweigh these challenges, especially for long-term investors.