Introduction

A diversified portfolio is the cornerstone of successful investing. By spreading investments across various asset classes, sectors, and geographies, investors can minimize risk and enhance returns. This guide delves into the principles, strategies, and benefits of maintaining a diversified portfolio, providing actionable insights for investors at all levels.

What is a Diversified Portfolio?

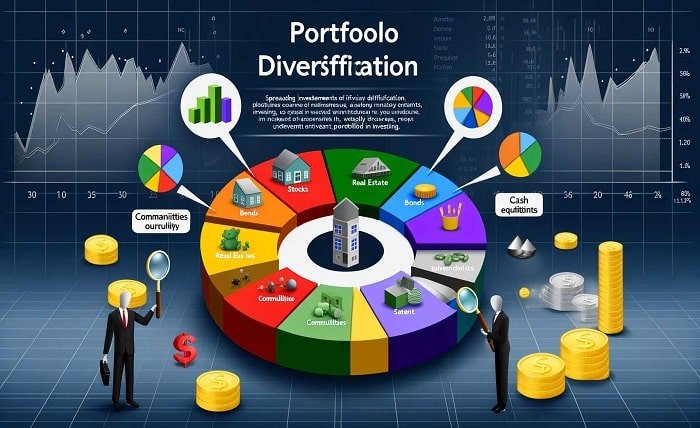

A diversified portfolio consists of a mix of different investments to reduce risk. This means holding a variety of assets such as stocks, bonds, real estate, and other securities. The goal is to ensure that the performance of one asset does not significantly impact the overall portfolio, thereby stabilizing returns over time.

The Importance of Diversification

Diversification is crucial because it helps mitigate risk. In a diversified portfolio, poor performance in one asset class can be offset by gains in another. This balance reduces the overall volatility of the portfolio and protects against market downturns, making diversification a fundamental strategy for long-term investment success.

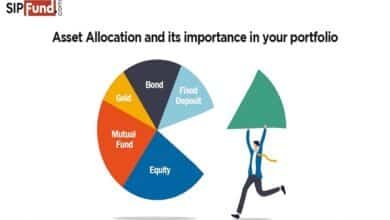

Asset Classes in a Diversified Portfolio

To build a diversified portfolio, it is essential to understand the different asset classes available. These typically include stocks, bonds, real estate, commodities, and cash equivalents. Each asset class has unique characteristics and behaves differently under various market conditions, contributing to the overall stability and growth of a diversified portfolio.

Diversification Strategies

There are several strategies to achieve a diversified portfolio. These include asset allocation, sector diversification, geographical diversification, and investing in both growth and value assets. By employing these strategies, investors can create a robust diversified portfolio that can weather market fluctuations and capitalize on various opportunities.

Building a Diversified Portfolio

Building a diversified portfolio involves careful planning and analysis. Start by assessing your financial goals, risk tolerance, and investment horizon. Then, allocate your investments across different asset classes and sectors based on these factors. Regularly review and adjust your portfolio to ensure it remains diversified and aligned with your objectives.

Sector Diversification in a Portfolio

Sector diversification is an essential aspect of a diversified portfolio. This involves spreading investments across different industries, such as technology, healthcare, finance, and consumer goods. By doing so, investors can avoid overexposure to any single sector and reduce the impact of sector-specific risks on their diversified portfolio.

Geographical Diversification

Geographical diversification involves investing in assets from different regions around the world. A geographically diversified portfolio can benefit from the growth potential of emerging markets while reducing exposure to any single country’s economic downturn. This global approach enhances the resilience of a diversified portfolio.

Risk Management in a Diversified Portfolio

Effective risk management is integral to maintaining a diversified portfolio. This includes regularly monitoring asset performance, rebalancing the portfolio, and staying informed about market trends. By actively managing risk, investors can protect their diversified portfolio and ensure it remains on track to meet their financial goals.

Rebalancing a Diversified Portfolio

Rebalancing is the process of adjusting the weights of assets in a diversified portfolio to maintain the desired level of diversification. Over time, some investments may grow faster than others, causing the portfolio to become unbalanced. Regular rebalancing helps realign the portfolio with the investor’s original allocation strategy, preserving the benefits of diversification.

The Role of Mutual Funds and ETFs in Diversification

Mutual funds and exchange-traded funds (ETFs) are popular tools for achieving a diversified portfolio. These investment vehicles pool money from multiple investors to purchase a broad range of assets, providing instant diversification. They are particularly useful for individual investors looking to build a diversified portfolio without having to manage numerous individual securities.

The Impact of Market Conditions on a Diversified Portfolio

Market conditions can significantly affect the performance of a diversified portfolio. During economic expansions, certain asset classes may outperform, while others may lag. Conversely, in a downturn, defensive assets like bonds may provide stability. Understanding how different market conditions impact various components of a diversified portfolio is crucial for effective portfolio management.

Technology and Diversification

Technology has revolutionized the way investors build and manage a diversified portfolio. Online platforms and robo-advisors offer automated portfolio management services that utilize sophisticated algorithms to create and maintain a diversified portfolio. These tools make it easier for investors to achieve and sustain diversification with minimal effort.

Conclusion

A diversified portfolio is essential for minimizing risk and maximizing returns over the long term. By understanding the principles of diversification and implementing effective strategies, investors can build a resilient and profitable portfolio. Regular monitoring, rebalancing, and adapting to market conditions will ensure that your diversified portfolio continues to meet your financial goals.

FAQs

1. What is a diversified portfolio?

A diversified portfolio includes a mix of various asset classes such as stocks, bonds, and real estate to minimize risk and stabilize returns.

2. Why is diversification important in investing?

Diversification reduces risk by spreading investments across different assets, so poor performance in one does not significantly impact the entire portfolio.

3. How can I start building a diversified portfolio?

Begin by assessing your financial goals, risk tolerance, and investment horizon. Allocate your investments across different asset classes and regularly review and adjust your portfolio.

4. What are some common strategies for diversification?

Common strategies include asset allocation, sector diversification, geographical diversification, and investing in both growth and value assets.

5. How often should I rebalance my diversified portfolio?

It’s advisable to rebalance your diversified portfolio at least once a year or whenever your asset allocation deviates significantly from your target.