Asset Allocation: The Key to a Balanced Investment Portfolio

Introduction

Asset allocation is a fundamental concept in investment strategy, essential for anyone looking to build a balanced and diversified portfolio. It involves spreading investments across various asset classes to reduce risk and maximize returns. Understanding asset allocation can significantly enhance your investment outcomes, providing stability and growth potential.

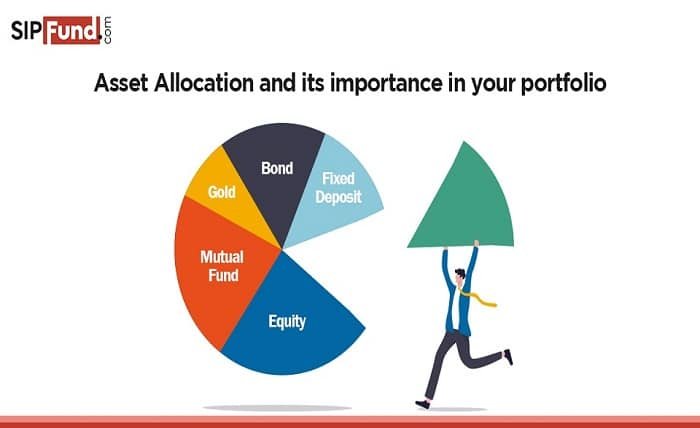

What is Asset Allocation?

Asset allocation is the process of dividing an investment portfolio among different asset categories, such as stocks, bonds, real estate, and cash. The goal of asset allocation is to balance risk and reward by apportioning assets according to an individual’s goals, risk tolerance, and investment horizon. Effective asset allocation can help manage risk and improve the likelihood of achieving financial goals.

The Importance of Asset Allocation

The importance of asset allocation cannot be overstated. It plays a critical role in determining both the risk and return of an investment portfolio. Studies have shown that asset allocation is responsible for the majority of the variability in a portfolio’s returns, more so than individual asset selection. By diversifying across various asset classes, investors can protect themselves against significant losses in any single investment.

Different Asset Classes

To master asset allocation, it’s crucial to understand the different asset classes available. The primary asset classes include equities (stocks), fixed income (bonds), real estate, and cash equivalents. Each asset class has distinct characteristics, risk levels, and potential returns. Equities, for example, offer high growth potential but come with higher volatility, while bonds provide more stable returns with lower risk.

Determining Your Risk Tolerance

Before diving into asset allocation, determining your risk tolerance is essential. Risk tolerance is your ability and willingness to endure market volatility and potential losses in your investment portfolio. Factors influencing risk tolerance include your financial situation, investment goals, time horizon, and psychological comfort with risk. Understanding your risk tolerance will guide your asset allocation decisions.

Setting Your Investment Goals

Setting clear investment goals is a fundamental step in asset allocation. Your goals might include saving for retirement, buying a home, funding education, or generating passive income. These goals will influence your time horizon and risk tolerance, which in turn will affect your asset allocation strategy. Having well-defined goals helps create a tailored asset allocation plan.

The Role of Diversification in Asset Allocation

Diversification is a core principle of asset allocation. By spreading investments across various asset classes and sectors, you can reduce the risk of significant losses. Diversification aims to balance the performance of your portfolio, ensuring that poor performance in one area is offset by better performance in another. This approach can lead to more stable returns over time.

Strategic vs. Tactical Asset Allocation

There are two primary approaches to asset allocation: strategic and tactical. Strategic asset allocation involves setting a long-term asset mix based on your investment goals, risk tolerance, and time horizon. This approach requires periodic rebalancing to maintain the desired asset mix. Tactical asset allocation, on the other hand, allows for short-term adjustments based on market conditions, aiming to capitalize on opportunities or mitigate risks.

Rebalancing Your Portfolio

Rebalancing is an essential aspect of maintaining your asset allocation strategy. Over time, the performance of different assets will cause your portfolio’s allocation to drift from its original target. Regular rebalancing involves buying or selling assets to restore the original asset mix. This discipline helps manage risk and ensures that your portfolio remains aligned with your investment goals.

The Impact of Time Horizon on Asset Allocation

Your investment time horizon significantly impacts your asset allocation strategy. A longer time horizon allows for a higher allocation to riskier assets, such as equities, since there is more time to recover from market downturns. Conversely, a shorter time horizon necessitates a more conservative approach, with a higher allocation to stable, income-generating assets like bonds.

The Benefits of a Customized Asset Allocation Plan

A customized asset allocation plan tailored to your individual needs and circumstances can provide numerous benefits. It ensures that your investment strategy is aligned with your risk tolerance, time horizon, and financial goals. A personalized plan can enhance your confidence in your investment decisions and improve your ability to stay the course during market fluctuations.

Common Mistakes in Asset Allocation

Avoiding common mistakes in asset allocation can improve your investment outcomes. Some frequent errors include neglecting to rebalance, over-concentrating in a single asset class, chasing performance, and failing to consider changes in personal circumstances. Staying disciplined and adhering to a well-thought-out asset allocation plan can help mitigate these mistakes.

Conclusion

Mastering asset allocation is essential for building a robust and diversified investment portfolio. By understanding different asset classes, determining your risk tolerance, setting clear investment goals, and regularly rebalancing your portfolio, you can optimize your investment strategy. A well-executed asset allocation plan provides the foundation for long-term financial success.

FAQs

1. What is asset allocation?

Asset allocation is the process of dividing an investment portfolio among different asset categories, such as stocks, bonds, real estate, and cash, to balance risk and reward.

2. Why is asset allocation important?

Asset allocation is crucial because it determines the risk and return of an investment portfolio, helping to manage risk and improve the likelihood of achieving financial goals.

3. How does risk tolerance affect asset allocation?

Risk tolerance influences asset allocation by determining the mix of assets in a portfolio. Higher risk tolerance allows for more equities, while lower risk tolerance favors more stable investments like bonds.

4. What is the difference between strategic and tactical asset allocation?

Strategic asset allocation sets a long-term asset mix based on goals and risk tolerance, requiring periodic rebalancing. Tactical asset allocation allows short-term adjustments based on market conditions to capitalize on opportunities or mitigate risks.

5. How often should I rebalance my portfolio?

Rebalancing should typically be done annually or semi-annually, but it can also be triggered by significant changes in market conditions or personal financial circumstances.