Introduction

Creating a solid investment portfolio is essential for anyone looking to secure their financial future. An investment portfolio is a collection of assets that can include stocks, bonds, real estate, and other investments. The right mix of assets can provide growth, income, and stability. This guide will help you understand how to build and manage an investment portfolio that aligns with your financial goals.

What is an Investment Portfolio?

An investment portfolio is a compilation of various financial assets such as stocks, bonds, mutual funds, real estate, and other investments. The goal of an investment portfolio is to diversify investments to reduce risk and increase potential returns. Understanding what makes up an investment portfolio is the first step toward effective investment management.

The Importance of Diversification

Diversification is a key strategy in managing an investment portfolio. By spreading investments across different asset classes and sectors, you can reduce the risk of significant losses. Diversification ensures that if one investment performs poorly, others may perform well, balancing the overall performance of your investment portfolio.

Setting Financial Goals

Before building an investment portfolio, it’s crucial to set clear financial goals. These goals will guide your investment decisions and help you determine the appropriate asset allocation. Whether you’re saving for retirement, a down payment on a house, or your children’s education, having specific goals will shape the structure of your investment portfolio.

Risk Tolerance

Your risk tolerance is an essential factor in building an investment portfolio. Risk tolerance refers to your ability and willingness to endure market volatility and potential losses. Assessing your risk tolerance involves considering your financial situation, investment time horizon, and personal comfort with risk. A well-constructed investment portfolio will align with your risk tolerance.

Asset Allocation Strategies

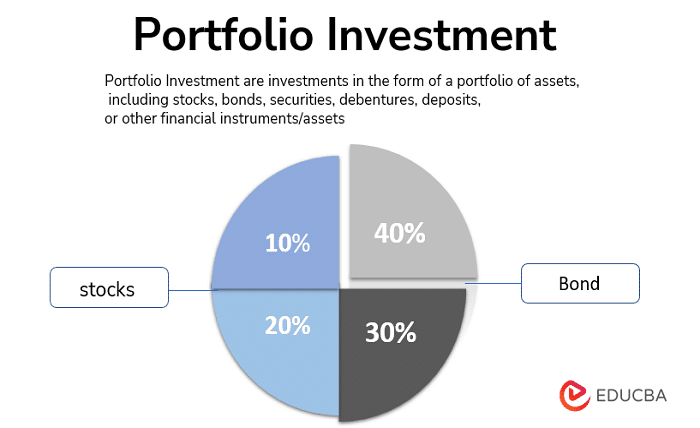

Asset allocation is the process of dividing your investment portfolio among different asset categories, such as stocks, bonds, and cash. The right asset allocation depends on your financial goals, risk tolerance, and investment horizon. Common strategies include conservative, moderate, and aggressive asset allocations, each offering different levels of risk and return.

Types of Investments

Understanding the different types of investments is crucial for building a diverse investment portfolio. Common investment types include:

- Stocks: Equities that represent ownership in a company and offer potential for high returns.

- Bonds: Fixed-income securities that provide regular interest payments and lower risk.

- Mutual Funds: Pooled funds that invest in a diversified portfolio of stocks, bonds, or other assets.

- ETFs (Exchange-Traded Funds): Similar to mutual funds but traded on stock exchanges.

- Real Estate: Physical properties or REITs (Real Estate Investment Trusts) that offer rental income and potential appreciation.

- Commodities: Physical assets like gold, silver, and oil that can hedge against inflation.

Building Your Investment Portfolio

Building an investment portfolio involves selecting the right mix of assets based on your financial goals, risk tolerance, and investment horizon. Start by determining your asset allocation, then choose specific investments within each asset class. Regularly review and adjust your investment portfolio to ensure it remains aligned with your objectives.

Managing and Rebalancing Your Portfolio

Effective management of an investment portfolio requires regular monitoring and rebalancing. Rebalancing involves adjusting your asset allocation back to its original or target levels. This process helps maintain your desired risk level and can improve long-term returns. Rebalancing your investment portfolio typically involves selling overperforming assets and buying underperforming ones.

Tax-Efficient Investing

Tax-efficient investing is an important consideration for managing an investment portfolio. Different investments have varying tax implications, and understanding these can help you minimize tax liabilities. Strategies such as tax-loss harvesting, holding investments in tax-advantaged accounts, and selecting tax-efficient funds can optimize your investment portfolio’s after-tax returns.

The Role of Professional Advisors

Professional financial advisors can provide valuable guidance in building and managing an investment portfolio. Advisors can help you develop a personalized investment strategy, select appropriate investments, and monitor your portfolio’s performance. Working with a professional can ensure that your investment portfolio aligns with your financial goals and risk tolerance.

Investment Portfolio for Different Life Stages

Your investment portfolio should evolve as you progress through different life stages. In your 20s and 30s, you might focus on growth-oriented investments with higher risk. As you approach retirement, shifting to a more conservative asset allocation can help preserve capital. Tailoring your investment portfolio to your life stage ensures it meets your changing financial needs.

Common Investment Mistakes to Avoid

Building and managing an investment portfolio involves avoiding common pitfalls. These include lack of diversification, emotional investing, neglecting to rebalance, and ignoring tax implications. By being aware of these mistakes, you can make more informed decisions and improve the long-term performance of your investment portfolio.

Conclusion

Building a robust investment portfolio requires careful planning, diversification, and regular management. By understanding your financial goals, risk tolerance, and the different types of investments, you can create an investment portfolio that aligns with your needs. Regularly review and adjust your portfolio to stay on track and achieve your financial objectives.

FAQs

1. What is the best way to start building an investment portfolio?

The best way to start building an investment portfolio is by setting clear financial goals, assessing your risk tolerance, and determining an appropriate asset allocation. Begin with a mix of diversified investments and gradually adjust your portfolio as you gain experience and your financial situation evolves.

2. How often should I rebalance my investment portfolio?

Rebalancing your investment portfolio is typically recommended once or twice a year. However, significant market movements or changes in your financial goals may require more frequent adjustments. Regular monitoring ensures your portfolio remains aligned with your risk tolerance and objectives.

3. What are the benefits of diversification in an investment portfolio?

Diversification in an investment portfolio helps reduce risk by spreading investments across various asset classes and sectors. This strategy can protect against significant losses if one investment performs poorly and can provide more stable returns over time.

4. Can I manage my investment portfolio on my own, or should I hire a financial advisor?

While many investors successfully manage their investment portfolios independently, hiring a financial advisor can provide valuable expertise and personalized guidance. Advisors can help develop a tailored investment strategy, select appropriate investments, and monitor performance, ensuring your portfolio aligns with your financial goals.

5. How do taxes impact my investment portfolio?

Taxes can significantly impact your investment portfolio’s returns. Understanding the tax implications of different investments and employing tax-efficient strategies, such as tax-loss harvesting and utilizing tax-advantaged accounts, can help minimize tax liabilities and optimize after-tax returns.