Introduction

The real estate market presents numerous opportunities and challenges that can seem overwhelming without the right information and strategies. This comprehensive guide will cover the key aspects of real estate, providing essential tips and insights for buyers, sellers, and investors to make informed decisions and optimize their outcomes in the property market.

Real Estate

Real estate involves the purchase, sale, and management of land and properties. It is a complex field that requires a solid understanding of market dynamics, legal requirements, and financial implications. This section will explore the foundational concepts of real estate, including the different types of properties and the fundamental principles of real estate transactions.

The Buyer’s Guide to Real Estate

For those looking to purchase real estate, whether for personal use or as an investment, knowing what to look for in a property is crucial. This part of the blog will discuss how potential buyers can identify valuable properties, understand the buying process, and negotiate effectively to secure the best deals in the real estate market.

Effective Selling Strategies in Real Estate

Sellers in the real estate market need to position their properties attractively to maximize their returns. This section will offer strategies for sellers, including tips on staging a home, determining the right asking price, and marketing properties to reach the widest possible audience.

Real Estate Investment Insights

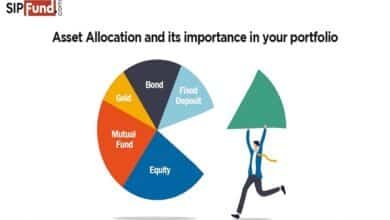

Investing in real estate can be one of the most lucrative ventures if done correctly. This segment will delve into the various forms of real estate investments, such as residential rentals, commercial properties, and real estate investment trusts (REITs), and provide advice on evaluating investment opportunities and managing risk.

Navigating Real Estate Financing

Financing is a critical aspect of real estate transactions. Here, we will cover the different types of mortgages and loans available, how to secure financing, and the implications of various financing options on the overall cost of buying real estate.

The Impact of Market Trends on Real Estate

Real estate is highly sensitive to changes in the economy and shifts in consumer behavior. This section will analyze current market trends, including the effects of economic cycles on real estate values and how potential buyers, sellers, and investors can use this information to their advantage.

Legal Considerations in Real Estate

Understanding the legal aspects of real estate is essential to ensure compliance and protect one’s interests. This part of the post will discuss key legal issues such as property rights, contracts, and the implications of zoning laws on real estate transactions.

Technology and Innovation in Real Estate

The real estate market is increasingly influenced by technological advancements. This section explores how digital tools and platforms are transforming real estate transactions, from virtual property tours to blockchain-based contracts and automated transaction processes.

Real Estate Market Analysis Techniques

To succeed in real estate, one must be able to analyze and interpret market data effectively. This segment will provide techniques for conducting comprehensive real estate market analysis, helping stakeholders make data-driven decisions.

Building a Real Estate Network

A strong network can be a significant asset in the real estate industry. This final section will offer tips on building and maintaining relationships with other real estate professionals, including agents, brokers, investors, and legal experts, which can lead to more opportunities and better deals.

Conclusion

The real estate market offers diverse opportunities for those willing to learn its intricacies. Whether you’re buying, selling, or investing, the key to success lies in understanding the market dynamics, being well-prepared legally and financially, and leveraging professional networks. By adhering to the strategies and insights provided in this guide, you can navigate the real estate landscape more confidently and effectively.

FAQs

1. What is the best time to buy real estate?

The best time to buy real estate often depends on market conditions, interest rates, and personal financial readiness. It’s crucial to monitor market trends and consult with real estate experts before making a decision.

2. How can I determine the value of a property?

Property value can be determined through various methods including comparative market analysis, professional appraisals, and by calculating the potential income it can generate if used as a rental property.

3. What are the risks of real estate investment?

Risks in real estate investment include market volatility, liquidity constraints, tenant issues in rental properties, and unexpected maintenance costs. Thorough research and proper management strategies can help mitigate these risks.

4. Can technology really help in buying real estate?

Yes, technology offers various tools that make buying real estate easier and more efficient, such as online listings, virtual tours, and automated valuation models, which can help buyers make informed decisions.

5. What should be included in a real estate contract?

A real estate contract should include terms about the price, deposit, closing date, contingencies (like financial and inspection), and details about who pays for certain costs like inspections and closing fees. It’s advisable to have a real estate attorney review any contract before signing.