Introduction

In the interconnected realm of finance, traders must possess a keen understanding of the traders’ world map. This map represents the global landscape of markets, currencies, and economies, where traders navigate to seize opportunities and mitigate risks. In this guide, we delve into the intricacies of the traders’ world map, exploring how traders strategically maneuver across regions and asset classes to achieve success.

The Traders’ World Map

To effectively navigate the traders’ world map, traders must comprehend its multifaceted layers. From the bustling streets of Wall Street to the vibrant markets of Asia, each region presents unique opportunities and challenges for traders.

Exploring Key Market Centers

Major financial hubs such as New York, London, Tokyo, and Hong Kong serve as pivotal nodes on the traders’ world map. These centers drive global market trends, offering liquidity and volatility that attract traders from around the globe.

Leveraging Currency Dynamics

Currencies form the backbone of the traders’ world map, shaping the ebb and flow of international trade and investment. Traders adept at understanding currency dynamics can capitalize on fluctuations to maximize profits.

Adapting to Regional Economic Trends

Economic factors play a crucial role in shaping market sentiment and investment strategies. Traders must stay attuned to regional economic trends, adjusting their positions accordingly to navigate the traders’ world map successfully.

Embracing Global Diversification

Diversification is key to mitigating risks in the traders’ world map. By spreading investments across different regions and asset classes, traders can safeguard their portfolios against localized shocks and market volatility.

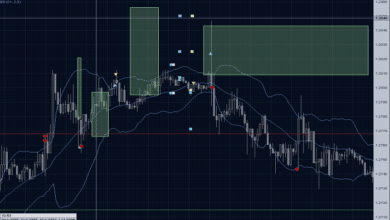

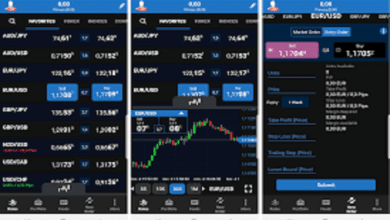

Utilizing Technology for Market Analysis

In the digital age, technology has revolutionized how traders navigate the world map. Advanced analytics, algorithmic trading, and real-time data enable traders to make informed decisions and capitalize on market opportunities with precision.

Navigating Geopolitical Risks

Geopolitical tensions can significantly impact the traders’ world map, causing sudden shifts in market dynamics. Traders must assess geopolitical risks and adapt their strategies accordingly to navigate turbulent waters successfully.

Harnessing the Power of Global Networks

Building a robust network of contacts across different regions is invaluable for traders navigating the world map. These connections provide insights into local market dynamics and access to lucrative opportunities.

Adhering to Regulatory Frameworks

Regulatory compliance is paramount for traders operating in the global marketplace. Understanding and adhering to regulatory frameworks across different jurisdictions is essential to avoid legal pitfalls and protect investments.

The Future of Trading: Innovation and Evolution

As technology continues to advance and global markets evolve, the traders’ world map undergoes constant transformation. Traders must embrace innovation and adapt to emerging trends to stay ahead in an ever-changing landscape.

Conclusion

Navigating the traders’ world map requires a combination of knowledge, skill, and adaptability. By understanding the intricacies of global markets, leveraging technology, and embracing diversification, traders can chart a course to success in the dynamic world of finance.

FAQ

1. What is the traders’ world map?

- The traders’ world map represents the global landscape of markets, currencies, and economies that traders navigate to seize opportunities and mitigate risks.

2. How do traders leverage currency dynamics?

- Traders analyze currency fluctuations to capitalize on market movements, such as buying low and selling high, or engaging in currency carry trades.

3. Why is global diversification important for traders?

- Global diversification helps traders mitigate risks by spreading investments across different regions and asset classes, reducing exposure to localized shocks and market volatility.

4. How do geopolitical risks impact the traders’ world map?

- Geopolitical tensions can cause sudden shifts in market dynamics, affecting currency values, commodity prices, and investor sentiment, thus requiring traders to adapt their strategies accordingly.

5. What role does technology play in navigating the traders’ world map?

- Technology provides traders with advanced analytics, real-time data, and algorithmic trading tools, enabling them to make informed decisions and capitalize on market opportunities with precision.