Assess Risk Tolerance: A Comprehensive Guide for Investors

Introduction

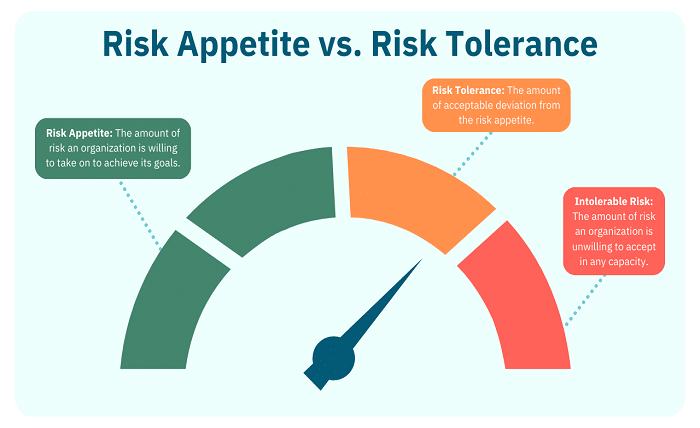

Risk tolerance is a fundamental concept in investing, referring to an individual’s ability and willingness to endure fluctuations in the value of their investments. To make sound financial decisions, it is essential to assess risk tolerance accurately. Whether you are a seasoned investor or just starting, understanding how to assess risk tolerance will help you create a portfolio that aligns with your financial goals and personal comfort level.

Why Is It Important to Assess Risk Tolerance?

Assessing risk tolerance is the first step in crafting a successful investment strategy. It helps investors understand how much risk they are comfortable taking on, which in turn influences asset allocation and investment choices. If you assess risk tolerance accurately, you can avoid making impulsive decisions during market downturns and stick to a long-term strategy that suits your financial objectives. Without this assessment, you might either take on too much risk, leading to potential losses, or be overly conservative, which could limit your returns.

Factors That Influence Risk Tolerance

Several factors can influence how you assess risk tolerance. These include your age, income, investment horizon, financial goals, and past experiences with investing. For example, younger investors often have a higher risk tolerance because they have more time to recover from potential losses. Conversely, those nearing retirement may prefer to take on less risk to preserve their capital. Understanding these factors is crucial when you assess risk tolerance, as they can significantly impact your investment decisions.

How to Assess Risk Tolerance: A Step-by-Step Guide

To assess risk tolerance effectively, it’s essential to follow a structured approach. Start by evaluating your financial situation, including your income, savings, and debt levels. Next, consider your investment goals—what do you want to achieve, and in what timeframe? Then, reflect on your psychological comfort with risk by imagining how you would react to various market scenarios. Finally, use online risk tolerance questionnaires to quantify your risk tolerance. By following these steps, you can assess risk tolerance in a comprehensive manner.

The Role of Risk Tolerance in Portfolio Diversification

When you assess risk tolerance, it directly influences how you diversify your investment portfolio. A well-diversified portfolio includes a mix of assets, such as stocks, bonds, and real estate, that align with your risk tolerance. If you have a high risk tolerance, you might lean towards a portfolio with a higher allocation to equities. Conversely, if your risk tolerance is low, you might prefer a mix that includes more bonds and other safer investments. Understanding how to assess risk tolerance ensures that your portfolio diversification strategy matches your comfort level with risk.

Tools and Resources to Assess Risk Tolerance

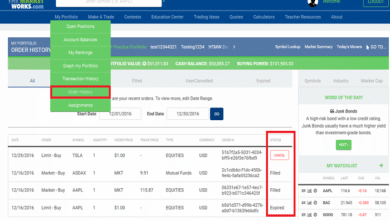

Several tools and resources are available to help investors assess risk tolerance. Many financial institutions offer online questionnaires that provide a risk tolerance score based on your answers. These tools consider factors like your investment horizon, financial situation, and emotional response to market fluctuations. Additionally, working with a financial advisor can provide personalized guidance to help you assess risk tolerance more accurately. Using these resources ensures that you have a clear understanding of your risk tolerance before making investment decisions.

Common Mistakes When Assessing Risk Tolerance

When you assess risk tolerance, it’s easy to make mistakes that can lead to suboptimal investment decisions. One common error is overestimating your risk tolerance, which can result in taking on more risk than you can handle emotionally or financially. Another mistake is not reassessing your risk tolerance regularly, especially after significant life changes, such as marriage, the birth of a child, or retirement. By being aware of these common pitfalls, you can assess risk tolerance more effectively and make better investment choices.

How to Adjust Your Portfolio Based on Risk Tolerance

Once you assess risk tolerance, it’s essential to adjust your portfolio accordingly. If your assessment reveals that you are uncomfortable with high volatility, consider reallocating your investments to include more conservative options, such as bonds or dividend-paying stocks. On the other hand, if you have a higher risk tolerance, you might choose to increase your exposure to growth-oriented assets, such as tech stocks or emerging markets. Regularly reassessing and adjusting your portfolio based on your risk tolerance helps you stay aligned with your financial goals.

The Relationship Between Risk Tolerance and Financial Goals

Your financial goals play a significant role in how you assess risk tolerance. For example, if your goal is to save for a down payment on a house in the next few years, you might have a lower risk tolerance and prefer safer investments. However, if you’re investing for retirement decades away, you might have a higher risk tolerance and be more willing to invest in riskier assets with the potential for higher returns. Understanding this relationship helps you assess risk tolerance in the context of your broader financial plan.

Risk Tolerance and Market Volatility

Market volatility is a critical factor to consider when you assess risk tolerance. Volatile markets can test your comfort level with risk, as the value of your investments may fluctuate significantly in a short period. It’s essential to assess risk tolerance honestly, considering how you would react to both market gains and losses. A realistic assessment of your risk tolerance helps you avoid panic selling during downturns and maintain your investment strategy through market cycles.

Reassessing Risk Tolerance Over Time

Risk tolerance is not static; it can change over time due to various factors, such as changes in your financial situation, life events, or shifts in the economic environment. It’s crucial to reassess risk tolerance periodically to ensure that your investment strategy remains aligned with your current circumstances. For instance, as you approach retirement, you may want to reassess risk tolerance and shift towards more conservative investments. Regularly updating your risk tolerance assessment helps you stay on track to meet your financial goals.

Working with a Financial Advisor to Assess Risk Tolerance

Working with a financial advisor can provide valuable insights when you assess risk tolerance. Advisors have the expertise to guide you through the assessment process, helping you understand your risk tolerance in the context of your overall financial plan. They can also offer personalized advice on how to structure your portfolio based on your risk tolerance and goals. By collaborating with a financial advisor, you can ensure that your investment strategy is well-suited to your risk tolerance and financial objectives.

Conclusion

Assessing risk tolerance is a critical component of successful investing. By understanding your risk tolerance, you can make informed decisions that align with your financial goals and personal comfort level. Whether you are just starting or are an experienced investor, regularly assessing your risk tolerance ensures that your investment strategy remains aligned with your evolving financial situation and objectives. With the right tools, resources, and guidance, you can assess risk tolerance effectively and build a portfolio that supports your long-term success.

FAQs

1. What is risk tolerance in investing?

Risk tolerance refers to an investor’s ability and willingness to endure fluctuations in the value of their investments. It is a crucial factor in determining the appropriate asset allocation for an investment portfolio.

2. How can I assess my risk tolerance?

You can assess risk tolerance by evaluating your financial situation, investment goals, and psychological comfort with risk. Using online questionnaires and consulting with a financial advisor can also help you quantify your risk tolerance.

3. Why is it important to assess risk tolerance?

Assessing risk tolerance is important because it helps you create an investment strategy that aligns with your financial goals and comfort level with risk. It prevents you from taking on too much or too little risk, both of which can impact your financial success.

4. How often should I reassess my risk tolerance?

It’s advisable to reassess your risk tolerance periodically, especially after significant life events or changes in your financial situation. Regular reassessment ensures that your investment strategy remains aligned with your current circumstances.

5. What should I do if my risk tolerance changes?

If your risk tolerance changes, it’s important to adjust your investment portfolio accordingly. This may involve reallocating assets to better match your current comfort level with risk and your financial goals.