Assessing Risk Tolerance: A Comprehensive Guide

Introduction

Assessing risk tolerance is a fundamental step in the financial planning process. It involves understanding how much risk an individual is willing and able to take when making investment decisions. Risk tolerance is not just about the potential for loss; it also encompasses an individual’s emotional response to market fluctuations and the ability to stay committed to an investment strategy during periods of volatility. In this comprehensive guide, we will explore the concept of risk tolerance, why it matters, and how you can assess your own risk tolerance effectively.

The Importance of Assessing Risk Tolerance

Before diving into investments, assessing risk tolerance is essential because it helps align your financial goals with the appropriate investment strategy. Without understanding your risk tolerance, you might end up with an investment portfolio that causes undue stress or, conversely, doesn’t generate the returns necessary to meet your financial objectives. Assessing risk tolerance ensures that your investments match your comfort level with risk, helping you maintain peace of mind and stay on track to achieve your goals.

Factors Influencing Risk Tolerance

Several factors influence how an individual assesses their risk tolerance. These include age, financial goals, time horizon, income level, and personal temperament. Younger investors often have a higher risk tolerance because they have more time to recover from potential losses, whereas older investors might prefer safer investments. Additionally, someone with a stable income may be more comfortable taking risks compared to someone with fluctuating income. Understanding these factors is crucial when assessing risk tolerance, as they help shape your investment strategy.

Psychological Aspects of Risk Tolerance

Psychology plays a significant role in assessing risk tolerance. Behavioral finance studies suggest that individuals often overestimate their risk tolerance during bull markets and underestimate it during bear markets. Emotions like fear and greed can lead to irrational decision-making, making it vital to assess risk tolerance in a way that accounts for psychological biases. Recognizing these biases and understanding how they influence your risk perception can help you make more informed investment decisions.

Methods for Assessing Risk Tolerance

There are several methods for assessing risk tolerance, ranging from self-assessment questionnaires to professional financial advice. Online risk tolerance quizzes are a popular starting point, offering a quick and easy way to gauge your comfort level with risk. However, these quizzes often lack the nuance needed for a comprehensive assessment. For a more detailed evaluation, working with a financial advisor who can take a holistic view of your financial situation is recommended. The key is to use a method that accurately reflects your risk preferences and financial circumstances.

The Role of Financial Advisors in Assessing Risk Tolerance

Financial advisors play a crucial role in assessing risk tolerance. They bring expertise and experience to the table, helping you navigate complex financial landscapes. A good advisor will not only assess your risk tolerance but also help you understand the implications of your risk profile on your investment strategy. They can provide personalized advice, taking into account your financial goals, time horizon, and other factors that influence risk tolerance. Working with a financial advisor ensures that your investment decisions are well-informed and aligned with your risk tolerance.

Aligning Investments with Risk Tolerance

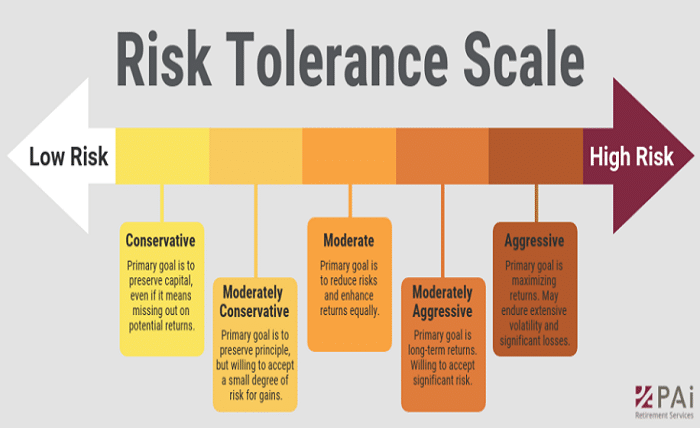

Once you have assessed your risk tolerance, the next step is to align your investments with your risk profile. This involves selecting asset classes and investment vehicles that match your comfort level with risk. For example, if you have a high risk tolerance, you might consider investing in stocks, which offer higher returns but come with greater volatility. On the other hand, if you have a low risk tolerance, bonds or other fixed-income securities may be more suitable. Assessing risk tolerance and aligning investments accordingly helps ensure that your portfolio meets your financial goals while minimizing stress.

Adjusting Risk Tolerance Over Time

Assessing risk tolerance is not a one-time activity. As your financial situation changes, your risk tolerance may also shift. Life events such as marriage, the birth of a child, or nearing retirement can impact how much risk you are willing to take. It’s important to reassess your risk tolerance periodically and adjust your investment strategy as needed. By regularly assessing risk tolerance, you can ensure that your portfolio remains aligned with your current financial goals and risk preferences.

The Impact of Market Conditions on Risk Tolerance

Market conditions can significantly influence an individual’s risk tolerance. During periods of market volatility, even those with a high risk tolerance may feel the urge to sell off risky assets. Conversely, in a bull market, investors might be tempted to take on more risk than is prudent. Assessing risk tolerance in the context of current market conditions is crucial for making rational investment decisions. It’s important to remember that your risk tolerance should be based on your long-term goals, not short-term market fluctuations.

The Relationship Between Risk Tolerance and Asset Allocation

Asset allocation is the process of distributing investments across various asset classes, such as stocks, bonds, and cash, to balance risk and reward according to your risk tolerance. Assessing risk tolerance is a critical step in determining the right asset allocation for your portfolio. A well-diversified portfolio that reflects your risk tolerance can help manage risk while aiming for the returns needed to meet your financial goals. Understanding this relationship is key to successful long-term investing.

Common Mistakes in Assessing Risk Tolerance

One of the most common mistakes in assessing risk tolerance is overestimating or underestimating one’s ability to handle risk. This can lead to an investment strategy that is either too aggressive or too conservative, neither of which is optimal. Another mistake is failing to reassess risk tolerance as life circumstances change. It’s also important to avoid letting emotions drive your risk tolerance assessment. Being aware of these common pitfalls can help you make a more accurate assessment of your risk tolerance and avoid costly mistakes.

Tools and Resources for Assessing Risk Tolerance

There are numerous tools and resources available for assessing risk tolerance. Online risk tolerance questionnaires, financial planning software, and professional financial advisors are some of the most commonly used resources. These tools can help you evaluate your risk tolerance more accurately and make informed investment decisions. Additionally, educational resources such as books, webinars, and courses on investing and risk management can provide valuable insights into how to assess and manage risk tolerance effectively.

Conclusion

Assessing risk tolerance is a critical component of successful financial planning. It involves understanding your comfort level with risk and aligning your investment strategy accordingly. By taking into account factors such as age, income, financial goals, and psychological biases, you can accurately assess your risk tolerance and make informed decisions about your investments. Regularly reassessing your risk tolerance as your circumstances change ensures that your investment strategy remains aligned with your financial goals. With the right approach, assessing risk tolerance can help you achieve a balanced and rewarding investment portfolio.

FAQs

1. What is risk tolerance?

Risk tolerance refers to the amount of risk an individual is willing and able to take when making investment decisions. It includes both emotional and financial factors that influence how comfortable someone is with potential losses.

2. How can I assess my risk tolerance?

You can assess your risk tolerance through self-assessment questionnaires, working with a financial advisor, or using online tools. It’s important to consider factors like age, income, financial goals, and psychological biases in your assessment.

3. Why is assessing risk tolerance important?

Assessing risk tolerance is important because it helps align your investment strategy with your comfort level with risk. This ensures that your portfolio meets your financial goals without causing undue stress.

4. How often should I reassess my risk tolerance?

It’s recommended to reassess your risk tolerance periodically, especially after major life events such as marriage, the birth of a child, or nearing retirement. This ensures that your investment strategy remains aligned with your current circumstances.

5. What are the common mistakes in assessing risk tolerance?

Common mistakes include overestimating or underestimating your ability to handle risk, failing to reassess risk tolerance as life circumstances change, and letting emotions drive your assessment. Avoiding these mistakes can help you make more accurate investment decisions.